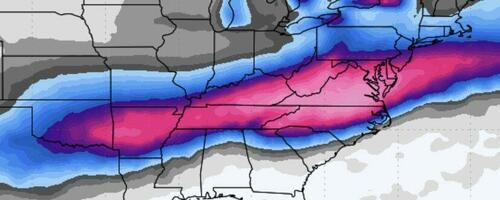

This Could Be The Big One

Authored by weather observer Ryan Hall,

There are winter storms, and then there are storms that come from a real pattern shift. The kind that don't just brush one region, but impact a big chunk of the country.

This upcoming setup is starting to look like the second type.

Over the last day or so, confidence has increased that we're heading into a legitimate winter storm window late this week into the weekend. The signal is becoming clearer across guidance, and the ingredients are lining up in a way that usually gets my attention.

The Big Picture

A strong Arctic high is pushing into the central and eastern United States. This isn't a quick shot of cold air. It's a deep, dense cold dome that sets up first and stays in place.

At the same time, a southern stream trough is expected to eject out of the Southwest. That system will pull moisture northward over the top of the cold air already in place at the surface.

That overrunning setup is one of the more efficient ways to produce widespread snow, sleet, and freezing rain across the South and East.

About the Analogs

You may see comparisons to past storms like January 1988 or February 2010 being mentioned. It's important to be careful with that.

No two storms are exactly alike, and analogs aren't about matching totals or impacts. Where they can be useful is in highlighting similar large-scale processes. In this case, things like a strong southwestern trough, deep cold air already in place, and a steady moisture feed overrunning the cold dome.

In some respects, this setup has more cold air to work with and a broader moisture source than those events did at similar lead times. That's why it stands out.

Days 4-5: Friday Focus

By Friday, attention shifts to the Southern Plains and the Lower Mississippi Valley.

Snow and mixed precipitation look increasingly likely from the Texas Panhandle through Oklahoma, Arkansas, and into parts of the Tennessee Valley. This part of the storm will likely feature a sharp gradient between snow, sleet, and freezing rain, especially near the southern edge of the cold air.

Small shifts in track or temperature profiles could have large impacts in this region.

Days 6-7: Weekend Evolution

As we head into Saturday and Sunday, the system is expected to move east across the Southeast, with the potential to turn northeast near the coast.

Cold air is already established well north of the system, which raises confidence that much of the precipitation will fall as wintry weather. The biggest question now is how far north the heavier precipitation shield extends and how much phasing occurs between northern and southern stream energy.

That will determine whether the highest impacts remain focused on the Mid-Atlantic or expand farther north.

What I'm Watching

-

Strength and placement of the Arctic high

-

Timing and amplitude of the southern stream trough

-

How quickly the streams interact

-

Placement of the rain-snow line

-

Icing potential along the southern edge

These details should come into better focus over the next few days.

Bottom Line

This is shaping up to be a potentially high-impact winter storm affecting a large portion of the Southern and Eastern U.S.

It's still too early to lock in exact totals or specific cities. But it's early enough to say this is a system worth taking seriously.

If you live from the Southern Plains through the Tennessee Valley and into the Mid-Atlantic, this is one you should be planning around, not ignoring.

We'll keep refining the details as the data comes in. If the signal weakens, we'll say that. But right now, this setup has the look of a storm that could end up being memorable.

Tyler Durden Mon, 01/19/2026 - 18:00

Source: 2weforum.org

Source: 2weforum.org President Donald Trump meets with Venezuelan opposition leader Maria Corina Machado in the Oval Office, during which she presented the President with her Nobel Peace Prize, on Jan. 15, 2026. Daniel Torok/The White House/Handout via Reuters

President Donald Trump meets with Venezuelan opposition leader Maria Corina Machado in the Oval Office, during which she presented the President with her Nobel Peace Prize, on Jan. 15, 2026. Daniel Torok/The White House/Handout via Reuters Mugshot: Ekelekamchukwu Alphonsus Ngwadom

Mugshot: Ekelekamchukwu Alphonsus Ngwadom

Google Streetview: the Rocky Mount residence listed as the location of Ngwadom’s deficient adult care facility

Google Streetview: the Rocky Mount residence listed as the location of Ngwadom’s deficient adult care facility The White House/Reuters

The White House/Reuters

Recent comments