Is There More To This Current Bird Flu Panic Than Meets The Eye?

Authored by Michael Snyder via TheMostImportantNews.com,

Why are global health officials issuing such ominous warnings about the bird flu? Do they know something that the rest of us do not?

H5N1 has been circulating all over the planet for several years now, and it has been the worst outbreak that the world has ever seen. Hundreds of millions of birds are already dead, and now H5N1 has been infecting mammals with alarming regularity. The good news is that so far it has not been a serious threat to humans, but could that soon change?

According to the World Health Organization, the possibility that H5N1 could start spreading among humans is an “enormous concern”…

The increasing spread of bird flu to humans is an ‘enormous concern’, the World Health Organization has warned.

The virus, an extremely deadly H5N1 subtype, has caused devastating declines in bird populations following its emergence in Europe in 2020.

It has since jumped to mammals such as cows, cats, seals and now people, raising the risk of the virus mutating to become more transmissible.

The fact that so many different types of mammals are now being infected is definitely alarming.

But perhaps cows would not be getting infected if we were not literally feeding them chicken crap…

As epidemiologists scramble to figure out how dairy cows throughout the Midwest became infected with a strain of highly pathogenic avian flu — a disease that has decimated hundreds of millions of wild and farmed birds, as well as tens of thousands of mammals across the planet — they’re looking at a standard “recycling” practice employed by thousands of farmers across the country: The feeding of animal waste and parts to livestock raised for human consumption.

“It seems ghoulish, but it is a perfectly legal and common practice for chicken litter — the material that accumulates on the floor of chicken growing facilities — to be fed to cattle,” said Michael Hansen, a senior scientist with Consumers Union.

It is not known if eating chicken crap is why so many cows in so many different states are being infected with H5N1.

But at a time when the bird flu is running rampant among chickens and turkeys, it seems very foolish to take chicken crap and feed it to our cows.

In any event, now there is a lot of panic about the potential for an H5N1 outbreak among humans.

Authorities at the WHO are warning that the death rate would be “extraordinarily high” if such an outbreak were to occur…

Experts at the WHO said humans face an ‘extraordinarily high’ mortality rate if the strain were to take hold, currently killing more than half of those infected.

I agree.

The bird flu is very dangerous, and if it starts spreading among humans on a widespread basis a lot of people will die.

So why are U.S. taxpayer dollars being used to fund experiments in China that are specifically designed to make bird flu viruses even more deadly? The following comes from an extremely shocking Daily Mail article…

Lawmakers are demanding answers after it was revealed the US is sending taxpayer dollars to a Chinese army lab to make bird flu viruses more dangerous to people.

Eighteen members of Congress are demanding answers from the Department of Agriculture (USDA) about the project, which was first revealed by DailyMail.com.

It is part of a $1million collaboration between the USDA and the CCP-run Chinese Academy of Sciences – the institution that oversees the Wuhan lab at the center of the Covid lab-leak theory.

In a scathing letter to USDA Secretary Tom Vilsack last week, the bipartisan group said: ‘This research, funded by American taxpayers, could potentially generate dangerous new lab-created virus strains that threaten our national security and public health.’

As I warn in my latest book, mad scientists all over the globe are taking some of the most deadly bugs even known to humanity and are purposely trying to make them even more deadly.

And way too often, your tax dollars are paying for it.

Of course experiments on H5N1 are not new.

Over a decade ago, gain of function experiments that were funded by Dr. Francis S. Collins and Dr. Anthony Fauci actually created a mutant version of H5N1 that “had gained the ability to spread through the air between ferrets”…

And yet in late 2011 the world learned that two scientific teams – one in Wisconsin, led by virologist Yoshihiro Kawaoka, and another in the Netherlands, led by virologist Ron Fouchier – had potentially pushed the virus in that direction. Each of these labs had created H5N1 viruses that had gained the ability to spread through the air between ferrets, the animal model used to study how flu viruses might behave in humans.

The ultimate goal of this work was to help protect the world from future pandemics, and the research was supported with words and funding by two of the most prominent scientists in the United States: Dr. Francis S. Collins, director of the National Institutes of Health, and Dr. Anthony Fauci, director of the NIH’s National Institute of Allergy and Infectious Diseases.

Why would they purposely create such a thing?

Ferrets were specifically chosen for that research because they have respiratory systems that are very similar to humans.

Our ability to create deadly diseases far exceeds our ability to control them, and once something gets out it can spread around the globe in the blink of an eye.

Right now, there is a lot of concern about a “mystery respiratory illness” that has suddenly appeared in Argentina…

A mystery respiratory illness has hospitalised dozens of people in Argentina in an outbreak that shares eerie similarities with Covid’s arrival.

Sixty patients have been sickened with ‘severe atypical pneumonia’ in the capital, Buenos Aires.

An alert about the cluster of cases was last night circulated via an international public health surveillance system.

Covid was brought to the attention of the world in late 2019 as a result of the same database, called ProMed.

Hopefully this will turn out to be nothing.

But it is just a matter of time before more great pestilences ravage our planet.

Will H5N1 be one of them?

I don’t know, but this is a story that I will definitely be watching closely.

* * *

Michael’s new book entitled “Chaos” is available in paperback and for the Kindle on Amazon.com, and you can check out his new Substack newsletter right here.

Tyler Durden Fri, 04/19/2024 - 18:40

(Illustration by The Epoch Times, Getty Images, Shutterstock)

(Illustration by The Epoch Times, Getty Images, Shutterstock) The NSA's Utah data collection center has Salt Lake City in the background, in Bluffdale, Utah, on March 17, 2017. The $1.5 billion data center is thought to be the worlds largest

The NSA's Utah data collection center has Salt Lake City in the background, in Bluffdale, Utah, on March 17, 2017. The $1.5 billion data center is thought to be the worlds largest A man sits in the shade of his umbrella while dogs play in the park under high tension power lines in Redondo Beach, Calif., on Aug. 16, 2020. California has ordered rolling power outages as a heat wave strains its electrical system. (Apu Gomes/AFP via Getty Images)

A man sits in the shade of his umbrella while dogs play in the park under high tension power lines in Redondo Beach, Calif., on Aug. 16, 2020. California has ordered rolling power outages as a heat wave strains its electrical system. (Apu Gomes/AFP via Getty Images)

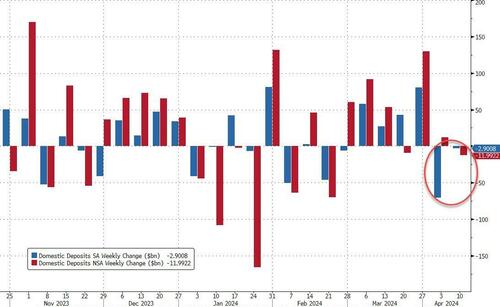

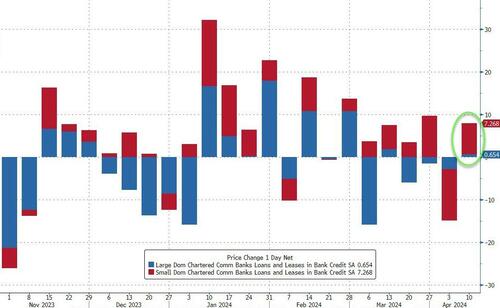

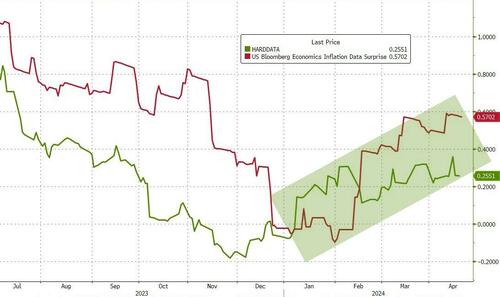

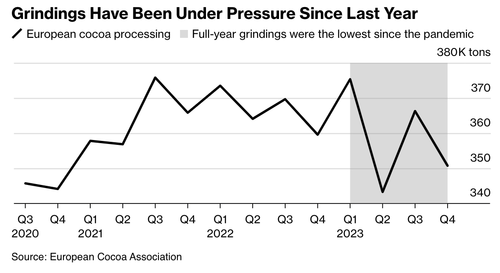

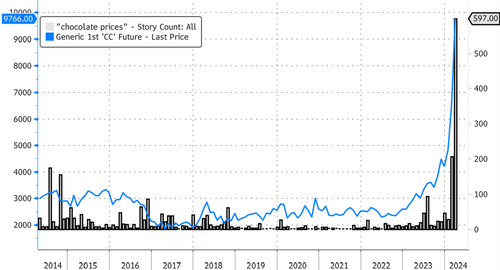

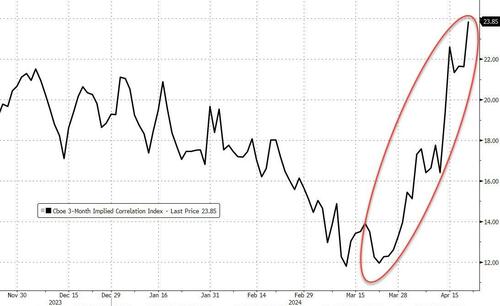

Source: Bloomberg

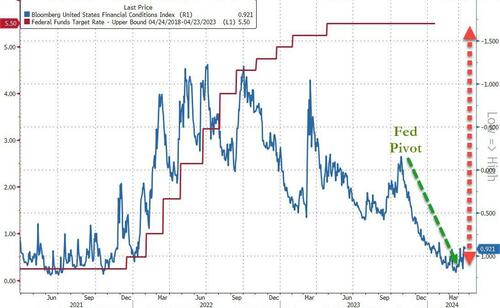

Source: Bloomberg

Recent comments