At The Money: Diversifying with Managed Futures ETFs (February 25, 2026)

Lots of asset classes promise uncorrelated returns, but few deliver diversification. One that does is managed futures. Sure, they are expensive and spikey, but when all correlations go to 1 – meaning everything is trading in lockstep, as we saw during the GFC and Covid – they seem to be the rare diversifier that works.

Full transcript below.

~~~

About this week’s guest:

Andrew Beer is a hedge fund veteran and founder of Dynamic Beta Investments, a firm focused on hedge-fund replication strategies delivered through low-cost, liquid vehicles like ETFs and mutual funds. His ETF, DBi Managed Futures Strategy (DBMF) attempts to replicate pricier managed futures portfolios

For more info, see:

Firm website

Masters in Business

LinkedIn

Twitter

~~~

Find all of the previous At the Money episodes here, and in the MiB feed on Apple Podcasts, YouTube, Spotify, and Bloomberg. And find the entire musical playlist of all the songs I have used on At the Money on Spotify

Transcript

Barry Ritholtz: As we learned in 2022, sometimes all supposedly uncorrelated asset classes moved together. Stocks went down, bonds went down, tips went down, commodities went down, Bitcoin went down. Very few things, buck the trend. One version of that is a variety of alternative investments that are designed to not correlate to one during periods of stress. Let’s talk to Andrew Beer. He’s a hedge fund veteran and founder of Dynamic Beta Investments, or DBI that focus on hedge fund replication strategies delivered through low cost liquid vehicles like ETFs and mutual funds, liquid alts, managed futures, a variety of strategies that are specifically designed to not trade like stocks and bonds. So, so Andrew, let, let’s start with the basic question. Stocks and bonds seems to have become a whole lot more correlated in recent years. How should that change how we think about correlation in the need for diversifiers?

Andrew Beer: Sure. Well, it, it, it is, it is the question of the 2020s from a wealth management perspective. So I used to call bonds the superman of diversifiers in the two thousands and, and 2000 tens in that they had terrific risk adjusted returns. If you, they almost never went down. The maximum draw down was 4%, and they tended to go up or do better when, but when, when equities were doing less. Well, the, the problem this decade is that, and this is, people have shown this over a long period of time since that was unusual. In fact, if you go back over long periods of time, particularly when inflation gets above about 2%, stocks and bonds tend to move together. So astonishingly bonds have earned less than cash over the past 10 years. And now, and the correlations have been creep creeping up. That tears up the basic playbook of a 60 40 model portfolio because, and so, so what, what people are doing is thinking about what can we put into a portfolio?

And really, really the goal is to diversify equity risk because remember, I mean, Warren Buffett had that great quote and they said, if you didn’t have Berkshire Hathaway, what would you do with your money? And he said, I put 95% into the S and P have 105% in cash. That’s great if you’re him and you can weather a 40% or 50% drawdown and, and breathe a whatever and, and, you know, carry it for the next, for the rebound. But most investors don’t have that kind of risk tolerance, and they need things that are gonna help to protect them during, during difficult market environments.

Barry Ritholtz: So how do we avoid these specific diversification failures that we see in typical portfolios? How do each of your funds map to a different hole in, in that diversification process?

Andrew Beer: So, on on, on our side, you know what we’ve tended to look at our strategies that, that are durable and have worked for long periods of time, and then try to find out ways to make them work in mutual funds or ETFs or in, in Europe, we do it in uses funds, but I’ve also been an enormous critic of the, this, this broad industry that is built up around what are called liquid alternative products. Now remember, I come from a legitimate hedge fund background, and when I’ve, but I’ve been writing about this category of supposed diversifiers for 15 years, and it’s a catastrophe that these strategies on average have correlations of often around 0.8 to equities, and they’ve delivered two to 3% per annum over a period of time when 15 years, when equities have gone up by 14 or 15% a year. That I think is the, is, is, is is the most critical issue, is that 95% of things that people will pitch you are, are, are supposed to work, just don’t and don’t add value. And so we have tried to address that and say, no, there actually are things that work. But you’ve gotta take a somewhat different approach in terms of how you think about it.

Barry Ritholtz: So when, whenever I speak to either portfolio managers or anybody else who’s, who’s working on an allocation, they wanna know about draw, draw downs and volatility and sharp ratios, what do these various diversifiers do to kind of wonky metrics like those, the—

Andrew Beer: Strategy that we’ve, we’ve described having the most diversification bang for the buck is a strategy called manage futures. And it’s, it’s the core of what we do. And we, we came at it again, we came at it from your side of the table as we were looking for something that would help our portfolios. And then there’s a second part of it. How do we make it work? Well, because there’s this great book that was written was called, Where Are the Customer’s Yachts? Talk about how Wall Street took all this money. The, the, the asset management industry tries desperately to take as much money as they can from any kind of product. And the more complicated they make it, the easier it is for ’em to charge exorbitant fees. But what, what, what the strategy is very, very unusual and has no correlation to stocks and bonds over a long period of time and, and tends to do best in the most difficult market environments. But it’s not a high sharp ratio strategy. There are certain hedge funds that have sharp ratios of two, which if, you know, if you under, it’s almost magical from an investment perspective, this is not that. But what was compelling about it is I can make it work and do better than the actual hedge funds, but in liquid accessible vehicles like ETFs.

Barry Ritholtz: Huh. So when I think of things like managed futures or derivative based long short leverage strategies, my first thought is what’s the risk that this is gonna blow up? I don’t tend to think of this as di certain ways. These are expressed as diversifiers. How, how do you reconcile that? How do you do things differently than some of these other blowup risk funds? We’ve, we’ve seen, and every year we read about one of ’em, you know, blowing up.

Andrew Beer: Many features is a strategy’s interesting. And the blowup risk is very, very low for the following reasons. So blowups usually happen because you’ve borrowed money and somebody wants it back at the wrong time and you have something you can’t sell to fulfill it. Right? That’s Lehman Brothers, that’s Bear Stearns. That’s, that’s, you know, that’s, that’s the long legacy of true blowups or, or, or it’s, it’s fraud and mispricing of assets. There was a mutual fund called Infinity Q that kind of just made up its numbers. The what managed futures funds. And, and again, it’s a terrible term managed futures, but futures contracts are some of the deepest, most liquid contracts that you can possibly trade. And so when things, these guys will go through periods where they have drawdowns, but they don’t hold onto the positions with a white knuckle grip and, and they, they scale out of positions.

Like even everyone was long gold and silver last week, they will have cut gold and silver. And so if gold and silver go down another 50% from here, they will have reduced their risk. So when you look at the overall strategy over a 25 year period of time, the maximum drawdown is only 16%. And whereas inequities, you’ve had a 40% and a 50% and several 20% plus drawdowns over that period of time, bonds have also had a 16% drawdown. So it’s, there’s a perception that it’s very, very risky with high blow up risk. That is in simply because as you say, it sounds like, and it is a leveraged long short der base black box,

Barry Ritholtz: But they’re called managed for a reason. Right? Yeah. So, so let’s talk about the tendency for some of these, especially on the private side, these various strategies to kind of quietly drift back towards equity beta over time. Like sometimes we see someone’s identified a particular strategy that is both non-correlated, diversified and, and generating real alpha, but tends not to have persistency. How do you avoid this kind of problem? What, what someone else has called fake diversification?

Andrew Beer: Well, I, I think the, the, the structure of the traditional asset management business from a return source perspective is deeply, deeply flawed. That again, you are talking about an industry that has destroyed value for decades net of the fees that they’ve charged because low cost index products have done better, right? The product development and sales across the industry is equally flawed. And that product in, in the hedge fund industry, when a credible hedge fund launches a product, they think there’s a great investment opportunity and they’re gonna bring in their, their capital clients and they’re gonna, and they’re gonna try to capitalize on that opportunity. In the traditional asset management space, it’s designed by the equivalent of the car salesman on the, on the showroom floor who thinks he can sell it to you. And all he cares about is getting that commission up front. So it, it’s, there’s a structural reason why hundreds and hundreds of products have been offered, which, which, which have failed any measure of diversification and also funds.

Ben Johnson at Morningstar has a great expression called the spaghetti cannon, and he said, these guys will launch six funds and they will come in and one of the six will be doing well, and that’s all they’ll talk to you about, right? So it, it’s, it’s, so the odds are really stacked against the average. And, you know, unless you’re somebody like me who digs in and wants to see every fund that’s out there and tear it apart, it’s, it’s, it’s extremely difficult to see through this marketing haze and fuzz. So, back to the point about things that were look great until they look horrible, I think that is a, that is a marketing success, but an investment catastrophe.

Barry Ritholtz: So, so let’s talk a little bit about the spaghetti canon. You’ve built a variety of replication strategies. How do you avoid simply layering on new sources of hidden risk under the banner of diversification? Just throwing stuff up against the wall to see what sticks isn’t a good strategy other than, hey, we know what we can market. How, how do you find diversification but not add risk?

Andrew Beer: So, so, so in our case, we’ve only, we only have two strategies because the other eight or 10 that we’ve looked at don’t work. If you, if I come in and describe to you what we built and why we built it, and now again, ours is a, is a relatively unusual business in that we’re basically saying in two hedge fund strategies, we like what hedge funds do, but we can beat them by copying them cheaply and we can do it in a liquid fashion that’s, that’s called hedge fund replication. We know, we figure out their big trades, we figure out where, where, where their conviction is. But instead of paying them a lot of money to implement the trades, often in very complicated ways, we can synthesize it and do it, do it efficiently. I’ve only launched strategies where I’ve been 80% confident I could beat hedge funds at their own game in that.

Barry Ritholtz: So, so let’s talk about some of those strategies, because when you, I think when a lot of people hear the I name hedge fund replication, they think, oh, hedge funds are buying a lot of Nvidia. So Andrew’s buying a lot of Nvidia. We’re not talking about imitating their positions, we’re talking about applying their strategies aside from managed futures, tell us about the other strategies, get that, get layered into DBI’s exchange traded funds.

Andrew Beer: So, so there’s, there’s only the one other strategy. So we, we replicate the managed future space and we synthesize their portfolios into a simple portfolio. And, and it turns out it’s just much more efficient. It does better over time. We also replicate what I would call the broad hedge fund industry, which will include the kind of funds you read about equity, long, short, relative value, event driven. But in that, we’re not trying to figure out who owns Nvidia. And we’ve looked at that, it doesn’t, it’s not a terribly useful exercise. Goldman actually has a, has a business doing that. Rather, what we’re trying to pick up on, are there big themes? So are they migrating their equity exposure from US equities to non-US equities? Is it going from developed markets to emerging markets? Is it, do they have hedges in place on the view that, you know, inflation may or may not come back.

So our whole business is based upon the idea that, that if you can identify the big trades, the most important trades, that’s really what’s gonna be the big driver of performance. And, and everybody’s read about the subprime crisis and what happened there. Just like, what don’t people say about the subprime crisis? Oh, that guy got it right, but shorted the wrong bonds. No, you shorted any bonds, you did well, right? If you were a hedge fund that moved into tech stocks over the past 15 years, you’ve done well, it hasn’t mattered which tech stocks you own that. And by the way, this only works in very limited circumstances. So back to your first point is the thing you don’t wanna do is you don’t want to do stupid things, which is to launch products because you hope they’re gonna work, or if they happen to work, your investors won’t figure it out until they’ve given you a lot of money. That’s not how we roll.

Barry Ritholtz: Huh. Really, really interesting. I’ve read a line of yours that I really like. Diversification is a protection against bad luck. Unpack what that means specifically in context of things like economic shocks or policy mistakes. We’re, we’re in an era of tariffs and trading by tweets as well as inflation surprises.

Andrew Beer: So, so the standard playbook from an asset allocation perspective is today to diversify and assume, just take it, it as a given that there won’t be any really catastrophic things that happen. You know, one of the great advantages that hedge funds as an asset class that drew me to the asset class as is, is, is they’re not, they’re not tied to a benchmark. They’re not tied to decisions that they made year before it. This is people with very, very smart, talented people with their own money who are trying to find ways to make money in good and bad environments. You know? And so, so bad luck is the return of inflation. You know, it’s something that affects your portfolio across the board that wasn’t part of your playbook. And the thing I find incredible about last year was that nothing broke, right? I mean, we have, we have, the system is being tested at every level.

Yeah, right? There are derelicts who are lighting matches and throwing them on the carpets and, and, and the drapes have not caught fire. Right? That we had an attack on the, you know, we had the deep seek scare, we had liberation day, we had frontal assault on, on the independence of the Fed. We’ve had various geopolitical skirmishes, you’ve had pockets of bond market tantrums around the world. And yet if you had gone to bed on December 31st, 2024 and woken up a year later, you think, great. Everything worked. So, so I, I think the world is changing, right? And I think what you’re seeing, what you’re seeing in gold and silver, it’s not normal, right? These, you don’t get these major asset classes melting up 80% in a year, going up another 20%, dropping 10%, you know, silver dropping 30% in a day. The, the, the, you know, I hear from international investors that, that their fear of something policy wide happening in the US is causing them to look at international markets in a way, even though the business environment in the US is still the best in the world, the companies are still the best in the world, but it’s not prudent anymore to be massively overweight the US.

So I think, I think we’re gonna be in for years of big change, and I think that that’s gonna be really challenging for the standard playbook of, of, of, you know, let’s just stick to our guns with our current positions and, and, and hope things work. It worked wonderfully in a year, like last year. I think we’re gonna go through some tough periods though.

Barry Ritholtz: Hmm. Interesting. So, so last question. ETFs tend to be used by advisors and, and other portfolio constructors who often have to explain what’s going on to their clients. And a big challenge is, a big struggle is dealing with client behavior. I think of selling diversifiers, like house insurance. You, you don’t complain if your house doesn’t burn down, but when I see things like managed futures and other diversifiers, I just know how clients think after a few years without a disaster, someone’s gonna say, Hey, these don’t work, I wanna sell this. How do you actually work with advisors? So the clients who thought they wanted a diversifier don’t get impatient when the house hasn’t burnt down.

Andrew Beer: So for, for one is, is is in our strategies, but reducing fees and making it more efficient, you do better during the other, during, during all those periods you’re talking about, right? So our largest ETF was up 14% last year. No, we weren’t up as much as the S and P of a hundred, but we’re pretty close. And that’s a year where nothing terrible happened other than, you know, we had a lot of, a lot of scary shocks. But, but I think, and, and, and I’ve, I’ve, I’ve loved the past six years of really getting to know people in the wealth management space, in that I think the way people often pitch these things to clients is wrong. That I think they, they go in, I think a lot of allocators, they fall in love with these funds. They go in and they want to tell people, I found, you know, Lionel Messi, I found LeBron James, I found this person because look, look at how they’ve done over the past five years.

They’re unbelievable. And I think that is a terrible way to introduce these products to a, a, a a, an end client. ’Cause then they’re focused on it all the time and they want to know why they’re not scoring every game. And, and rather what we have tried to do is basically say, look, we know this strategy is useful, but we’re the boring way of getting exposure to it. We’re just like that in no one, no one. And people generally don’t panic because GD is down 5% in a day. It’s just part of your asset allocation. And so I think the, the advisor world needs a will, will be more successful when they frame these allocations not on a standalone basis based upon star power. And it’s okay to pay them 200 basis points a year because they’re never gonna be wrong. We know they’re gonna be wrong and we know things aren’t gonna work. So if you frame it in terms of this is just simply incrementally that fills a gap in terms of how we manage your money. And it’s priced at a very, very attractive price point. No one’s getting rich while we’re waiting for this to happen. And five years from now, seven years from now, 10 years from now, just like when we started to put you into high yield bonds or non-US equities or these other asset classes that made your portfolio more robust, this is just one incremental addition to it.

Barry Ritholtz: So, so to wrap up, for investors looking to diversify, to, to avoid the tendency for all asset classes to move in lockstep, they should consider low cost ETFs that try and replicate what big expensive hedge funds do. But in a liquid inexpensive version, DBI has not only managed futures, but liquid alts that try and do this, they’ve put together a really impressive track record over the past five years. Just keep in mind that you don’t wanna back up the truck and own 20, 30% of it. It’s supposed to be an insurance product. Andrew suggests 3%. I, I don’t disagree with that. I’m Barry Ritholtz. You’ve been listening to Bloomberg’s At the Money.

~~~

Find our entire music playlist for At the Money on Spotify.

The post At the Money: Diversifying with Managed Futures ETFs appeared first on The Big Picture.

Former Secretary of State Hillary Clinton in Munich, Germany, on Feb. 14, 2026. Johannes Simon/Getty Images

Former Secretary of State Hillary Clinton in Munich, Germany, on Feb. 14, 2026. Johannes Simon/Getty Images

Former President Bill Clinton and former Secretary of State Hillary Clinton arrive for former President Donald Trump's inauguration as the next president of the United States in the Rotunda of the United States Capitol in Washington on Jan. 20, 2025. Shawn Thew/Reuters

Former President Bill Clinton and former Secretary of State Hillary Clinton arrive for former President Donald Trump's inauguration as the next president of the United States in the Rotunda of the United States Capitol in Washington on Jan. 20, 2025. Shawn Thew/Reuters

School buses bring in players from the Burbank Bulldogs and the Pasadena Bulldogs before their game at the Rose Bowl in Pasadena, Calif., on March 19, 2021. Harry How/Getty Images

School buses bring in players from the Burbank Bulldogs and the Pasadena Bulldogs before their game at the Rose Bowl in Pasadena, Calif., on March 19, 2021. Harry How/Getty Images

Matt Murray at an earlier meeting with Washington Post staff. Robert Miller/Washington Post/Getty Images

Matt Murray at an earlier meeting with Washington Post staff. Robert Miller/Washington Post/Getty Images

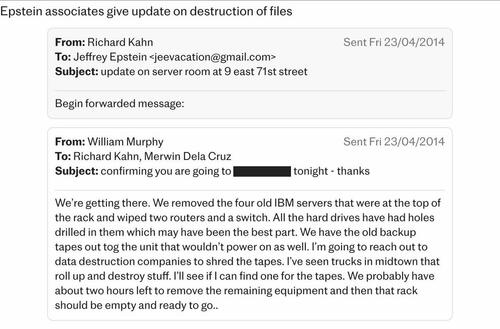

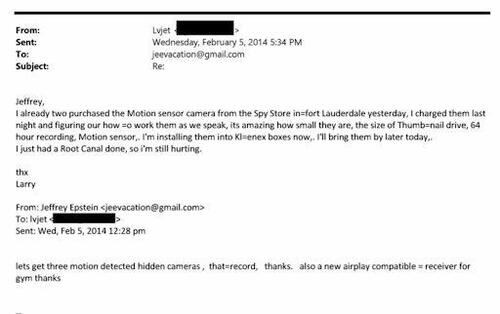

Pictures released by police show Epstein’s Paris home

Pictures released by police show Epstein’s Paris home

Recent comments