GE All-in-One Washer Dryer Manual: A Comprehensive Guide

This guide provides detailed instructions for GE combination washer dryer units, including model-specific manuals available on the official GE Appliances website.

Discover essential information regarding installation, operation, troubleshooting, and safety precautions for optimal performance and longevity of your appliance.

Understanding GE Combination Washer Dryer Models

GE combination washer dryers represent a space-saving solution, integrating washing and drying functionalities into a single unit. These appliances, like the GE Profile PFQ97HSPVDS 4.8 cu. ft. model, utilize ventless heat pump technology, eliminating the need for external venting – a significant advantage for apartments or spaces lacking traditional dryer ductwork.

Unlike separate washer and dryer sets, combo units typically have a smaller capacity for each cycle. Understanding this is crucial when selecting a model. GE offers various series, including the GFQ14, each with specific features and specifications. The all-in-one design streamlines laundry routines, but requires careful consideration of load sizes and cycle selections.

These models are designed for convenience, offering a range of wash and dry cycles to accommodate different fabric types and laundry needs. Proper usage, guided by the official GE Appliances manual downloadable from GE.com, ensures optimal performance and extends the appliance’s lifespan. Familiarizing yourself with the unique characteristics of these units is key to maximizing their benefits.

Locating Your Specific Model Number

Identifying your GE combination washer dryer’s model number is paramount for accessing the correct documentation and support resources. This unique identifier is essential when downloading the official GE Appliances manual from GE.com, ensuring you receive instructions tailored to your specific unit.

The model number is typically found on a label located in one of several places: inside the washer/dryer door, on the unit’s back panel, or on the appliance’s original packaging. It’s a combination of letters and numbers, such as PFQ97HSPVDS or GFQ14ESSNWW.

Having this number readily available streamlines troubleshooting, warranty claims, and contacting GE customer support. Without it, accessing accurate information becomes significantly more difficult. GE’s updated website directs users to standalone sites – GE Aerospace, GE Vernova, and GE HealthCare – but the appliance manuals remain accessible through the GE Appliances portal using your model number. Accurate identification is the first step towards effective appliance management.

Downloading the Official GE Appliances Manual

Accessing the official GE Appliances manual for your all-in-one washer dryer is straightforward and crucial for optimal use. Begin by visiting the official GE Appliances website – GE.com. Navigate to the support or owner’s manual section, typically found through a search bar or dedicated support link.

You will be prompted to enter your specific model number, which, as previously detailed, is located on the appliance itself or its original packaging. Inputting the correct model number ensures you download the manual specifically designed for your unit, including detailed instructions, safety information, and troubleshooting guides.

The manual is usually available as a downloadable PDF, allowing you to view it on any device; GE.com has been updated to reflect the company’s spin-offs (Aerospace, Vernova, Healthcare), but appliance manuals remain readily accessible. Downloading the manual empowers you to understand your appliance’s features and maintain its performance effectively.

Key Features of GE Profile PFQ97HSPVDS

The GE Profile PFQ97HSPVDS represents a premium all-in-one laundry solution, boasting a 4.8 cu. ft. capacity for handling substantial loads. Its defining characteristic is the integrated ventless heat pump technology, eliminating the need for external venting and offering installation flexibility. This innovative system efficiently dries clothes using a closed-loop process, conserving energy and reducing environmental impact.

This model features UltraFast Wash and Dry cycles, significantly reducing laundry completion times. SmartDispense technology automatically dispenses the correct amount of detergent for each load, optimizing cleaning performance and minimizing waste. The unit also incorporates steam functionality to refresh and sanitize garments, removing wrinkles and odors.

Furthermore, the PFQ97HSPVDS offers a range of customizable wash and dry cycles, catering to various fabric types and cleaning needs. Its sleek design and intuitive controls enhance the user experience, making laundry day more convenient and efficient. Detailed operation is available in the downloadable instruction manual.

GFQ14 Series: Overview and Specifications

The GE Combination GFQ14 series offers a compact and versatile laundry solution, ideal for smaller spaces. These 2.4 cu. ft. capacity units combine washing and condensing drying capabilities into a single appliance, eliminating the need for separate machines. Designed as front-load models, they prioritize space efficiency without compromising performance.

GFQ14 series washers feature multiple wash cycles, accommodating diverse fabric types and soil levels. The integrated condenser dryer utilizes ventless technology, simplifying installation as no external exhaust is required. This makes them suitable for apartments, condos, or areas lacking traditional venting options.

Key specifications include a standard 120V power supply and various control options for customized washing and drying. Access to the complete owner’s manual and installation instructions is readily available online through the GE Appliances website, ensuring users can maximize the appliance’s functionality and maintain optimal operation. Detailed support information is also provided.

Ventless Heat Pump Technology Explained

GE Profile PFQ97HSPVDS utilizes advanced ventless heat pump technology, representing a significant departure from traditional condenser dryers. Unlike vented or conventional condenser dryers, this system recirculates air within a closed loop, efficiently removing moisture without requiring an external exhaust vent.

The heat pump works by heating the air, passing it over the wet clothes to absorb moisture, and then cooling the air to condense the water. This process is remarkably energy-efficient, consuming significantly less electricity compared to conventional drying methods. The condensed water is collected in a reservoir for easy disposal;

This ventless design offers installation flexibility, eliminating the need for ductwork and allowing placement in various locations. Furthermore, the lower operating temperatures are gentler on fabrics, reducing the risk of shrinkage and damage. This innovative technology delivers powerful drying performance while prioritizing energy savings and fabric care.

Installation Instructions: General Guidelines

Prior to installation, carefully inspect the GE combination washer dryer for any shipping damage. Ensure you have the necessary tools, including a level, screwdriver, and potentially pliers, readily available. The unit requires a dedicated 120V electrical outlet; avoid using extension cords.

Position the appliance on a firm, level surface capable of supporting its weight, even when fully loaded. Adjust the leveling feet to eliminate any wobble. Water connections should be made according to local plumbing codes, utilizing new supply hoses. Because this is a ventless model, no external venting is required, offering installation flexibility.

Refer to the specific model’s owner’s manual – downloadable from the GE Appliances website using your model number – for detailed diagrams and step-by-step instructions. Proper installation is crucial for optimal performance and to prevent potential issues. Always follow safety precautions during the installation process.

Washer Cycle Options and Settings

GE combination units offer a variety of washer cycles to accommodate different fabric types and soil levels. Common cycles include Normal, Delicates, Heavy Duty, Quick Wash, and Bulky/Bedding. Temperature settings range from Hot, Warm, to Cold, allowing for customized washing.

Spin speed is also adjustable, with options for High, Medium, and Low, impacting water extraction and drying time. Utilize the “Sanitize” option for enhanced cleaning and disinfection, ideal for heavily soiled items or allergy sufferers. The “Steam” function can pre-treat stains and refresh garments.

For optimal results, consult your model’s manual for recommended cycle settings based on fabric care labels. Load size adjustments are crucial; avoid overloading to ensure thorough cleaning. Explore features like delayed start for convenient operation and automatic detergent dispensing (if equipped). Proper cycle selection maximizes cleaning efficiency and fabric protection;

Dryer Cycle Options and Settings

GE all-in-one units provide diverse dryer cycles tailored to various needs. Options typically include Normal, Delicates, Heavy Duty, Timed Dry, and Air Fluff. Temperature settings range from High, Medium, to Low, ensuring appropriate heat for different fabrics. Ventless heat pump technology offers energy efficiency and gentle drying.

Utilize the “Steam Refresh” cycle to reduce wrinkles and odors without full washing. The “Sanitize” cycle employs higher temperatures for enhanced disinfection. Moisture sensor technology automatically detects dryness levels, preventing over-drying and saving energy. Adjust the dryness level to your preference – More Dry, Medium Dry, or Less Dry.

Refer to your specific model’s manual for detailed cycle descriptions and recommended settings. Proper cycle selection protects fabrics and optimizes drying performance. Regularly clean the lint filter to maintain efficiency and prevent fire hazards. Explore features like wrinkle shield to minimize creasing.

Troubleshooting Common Issues

Encountering problems with your GE all-in-one washer dryer? Common issues include error codes, failure to start, insufficient drying, or excessive noise. First, verify the power supply and water connections. Check for overloaded drums or improper load balancing, which can cause vibrations.

If the unit doesn’t start, consult the error code section of your manual for specific diagnoses. Insufficient drying often stems from a clogged lint filter – clean it after each cycle. For drainage issues, inspect the drain hose for kinks or obstructions. Unusual noises may indicate foreign objects within the drum.

Before contacting support, attempt a power reset by unplugging the unit for several minutes. Refer to the manual for detailed troubleshooting steps related to specific error codes. Always prioritize safety; never attempt repairs while the unit is connected to power.

Error Codes and Their Meanings

GE all-in-one washer dryers utilize error codes to signal malfunctions, aiding in efficient troubleshooting. These codes, displayed on the unit’s control panel, pinpoint the source of the problem, ranging from water supply issues to internal component failures. A “WD” code often indicates a water drainage problem, potentially caused by a blocked drain hose.

“LE” signals an imbalance during the spin cycle, requiring load redistribution. “OE” typically denotes an overflow error, suggesting a water inlet valve malfunction. Other codes may relate to heating element failures, motor issues, or sensor errors. Your specific model’s manual provides a comprehensive list of error codes and their corresponding solutions.

Always consult the manual before attempting any repairs. Ignoring error codes can lead to further damage. Document the error code before contacting customer support for faster assistance. Understanding these codes empowers you to resolve minor issues independently and communicate effectively with service technicians.

Cleaning and Maintenance Procedures

Regular cleaning is crucial for maintaining your GE all-in-one washer dryer’s performance and longevity. After each use, wipe down the door gasket to prevent mildew growth. Monthly, run a cleaning cycle with a washer cleaner to remove detergent buildup and odors. The lint filter, located within the dryer compartment, requires cleaning after every drying cycle to ensure efficient airflow.

Periodically inspect the drain pump filter for obstructions like coins or debris. Clean the exterior surfaces with a damp cloth and mild detergent. Avoid abrasive cleaners that could damage the finish. For ventless models, ensure the condenser unit is free of dust and lint, following the manual’s specific instructions.

Proper maintenance extends the appliance’s lifespan and prevents costly repairs. Refer to your model’s manual for detailed cleaning schedules and recommended products. Ignoring these procedures can lead to reduced efficiency and potential malfunctions.

Safety Precautions and Warnings

Prioritize safety when operating your GE all-in-one washer dryer. Always disconnect the appliance from the power supply before performing any maintenance or cleaning. Never attempt to repair the unit yourself; contact a qualified technician for assistance. Ensure proper ventilation to prevent moisture buildup and potential mold growth.

Do not overload the washer or dryer, as this can cause damage and affect performance. Keep flammable materials away from the appliance. Supervise children when they are near the unit. Avoid using extension cords, and ensure the appliance is properly grounded.

Read and understand all warnings and instructions in the user manual before use. Improper installation or operation can create hazards. If you detect any unusual noises, smells, or malfunctions, immediately stop using the appliance and consult the troubleshooting section of the manual or contact GE support.

GE Company Spin-Off Information (Aerospace, Vernova, Healthcare)

Recent corporate restructuring at GE has resulted in the separation into three independent, publicly traded companies: GE Aerospace, GE Vernova, and GE HealthCare. This strategic move impacts the overall GE brand landscape, but does not directly alter the functionality or support for GE Appliances, including your all-in-one washer dryer.

While GE as a unified entity no longer exists, GE Appliances remains committed to providing comprehensive support for its products. Access to manuals, parts, and customer service remains readily available through the official GE Appliances website. The spin-offs primarily affect the aerospace, energy, and healthcare sectors.

GE.com now directs users to the individual company websites: GE Aerospace, GE Vernova, and GE HealthCare. This change ensures focused information and resources for each business. Your GE appliance warranty and service are unaffected by these corporate changes.

GE’s History and Future Outlook

General Electric’s legacy spans over a century of innovation, beginning with Thomas Edison’s pioneering work in electric lighting. Throughout its history, GE has consistently pushed technological boundaries, impacting numerous industries, including appliance manufacturing. This commitment to innovation continues to shape GE Appliances’ product development, including the advanced features found in all-in-one washer dryers.

The recent spin-offs – GE Aerospace, GE Vernova, and GE HealthCare – represent a strategic refocusing of the company. While the broader GE structure has evolved, GE Appliances operates as a distinct entity, dedicated to delivering high-quality home appliances.

Looking ahead, GE Appliances will continue to leverage its rich history of innovation to develop cutting-edge laundry solutions. Expect ongoing advancements in efficiency, smart technology, and user experience, ensuring GE remains a leader in the appliance market. The future focuses on empowering consumers with reliable and innovative products.

Resources for Support and Contact Information

For immediate assistance with your GE all-in-one washer dryer, the official GE Appliances website (GE.com) is your primary resource. Here, you can download user manuals specific to your model number – crucial for understanding features and troubleshooting. A comprehensive FAQ section addresses common concerns, offering quick solutions.

If you require direct support, GE Appliances provides multiple contact options. Their customer service team is available via phone, offering personalized assistance. Online chat support provides real-time help, and a dedicated support portal allows you to submit inquiries and track their progress.

Furthermore, GE’s updated website now directs users to the standalone sites for GE Aerospace, GE Vernova, and GE HealthCare. However, appliance support remains centralized on GE Appliances’ platform. Utilize these resources to ensure optimal performance and resolve any issues efficiently.

The post ge all in one washer dryer manual appeared first on Every Task, Every Guide: The Instruction Portal

.

Russian Ambassador to the UK Andrey Kelin, via Al Jazeera screenshot.

Russian Ambassador to the UK Andrey Kelin, via Al Jazeera screenshot. via Associated Press

via Associated Press

A Shein pop-up store at a mall in Singapore, on April 4, 2024. Edgar Su/Reuters

A Shein pop-up store at a mall in Singapore, on April 4, 2024. Edgar Su/Reuters

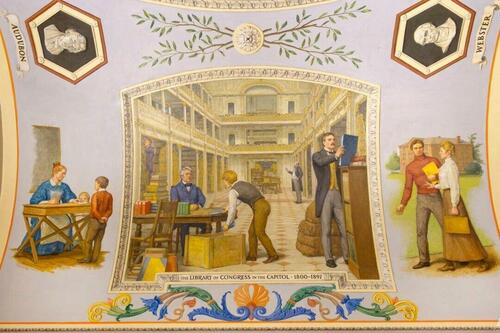

In 1783, Representative James Madison introduced a resolution to create a library that would give the Congress access to works about the laws of nations and about American history and affairs. The Library of Congress was then founded in 1800. This mural depicts the library in the Capitol in 1890. Public Domain

In 1783, Representative James Madison introduced a resolution to create a library that would give the Congress access to works about the laws of nations and about American history and affairs. The Library of Congress was then founded in 1800. This mural depicts the library in the Capitol in 1890. Public Domain

Illustrative narco-boats file, via X.

Illustrative narco-boats file, via X.

via Associated Press

via Associated Press Chloe Cole, an 18-year-old woman who regrets surgically removing her breasts, holds testosterone medication used for transgender patients, in Northern California on Aug. 26, 2022. John Fredricks/The Epoch Times

Chloe Cole, an 18-year-old woman who regrets surgically removing her breasts, holds testosterone medication used for transgender patients, in Northern California on Aug. 26, 2022. John Fredricks/The Epoch Times Chloe Cole stands near her home in Northern California on Aug. 26, 2022. John Fredricks/The Epoch Times

Chloe Cole stands near her home in Northern California on Aug. 26, 2022. John Fredricks/The Epoch Times Chloe Cole holds a childhood photo in Northern California on Aug. 26, 2022. John Fredricks/The Epoch Times

Chloe Cole holds a childhood photo in Northern California on Aug. 26, 2022. John Fredricks/The Epoch Times Chloe Cole speaks in support of the Protect Children's Innocence Act as Rep. Marjorie Taylor Greene (R-Ga.) looks on outside the U.S. Capitol in Washington on Sept. 20, 2022. Terri Wu/The Epoch Times

Chloe Cole speaks in support of the Protect Children's Innocence Act as Rep. Marjorie Taylor Greene (R-Ga.) looks on outside the U.S. Capitol in Washington on Sept. 20, 2022. Terri Wu/The Epoch Times

Recent comments