It's Time To Accept That Civil War 2.0 Has Already Started

Authored by Brandon Smith via Alt-Market.us,

In July of 1917 as the fires of WWI raged across Europe, the Russian city of Petrograd was facing its own special turmoil in the form of a large scale Bolshevik insurgency. Up to 500,000 protesters, agitators and provocateurs had entered the city from across the country, many of them armed. They took over large swaths of the metropolis, hijacked private vehicles and confiscated private buildings.

Some soviet leaders including Vladimir Lenin called the event “premature” and did not publicly endorse it, which may have been a calculated attempt to avoid direct blowback. The official historical explanation is that the insurrection had taken on a life of its own, but the stage had been set and the communist agitators got exactly what they wanted, what their strategy demanded:

Human sacrifice.

Clashes with government authorities led to hundreds of protester deaths and a handful of police casualties. The Russian government surged military forces into the region to arrest Bolshevik captains and the movement had to pull back. In the end, though, the primary goal of the insurgents had been achieved. Whether spontaneous or planned, the point of the communist methodology is always to trigger government violence which can then be used to create public sympathy and bolster the revolution.

The majority of “normies” don’t need to join the revolution, they just have to be convinced to stay out of the way. And that’s largely what happened a few months later in October of 1917 when the Red Terror began. What followed was five years of civil war.

The communists, who had long claimed to be innocent victims of the Tsarist “imperialism”, went on a murder spree as soon as they solidified their political power. Their ideological opponents were systematically rounded up and eliminated. There are no exact numbers on how many killings occurred because records were destroyed, but estimates suggest the revolutionaries and secret police arrested and executed around 1 million political dissidents in the first few years of communist rule.

This genocide, though, would pale in comparison to the 10 million deaths caused by the Russian Civil War. Not to mention the imprisonment and mass murder of millions of Christians by the atheist regime over the course of the next couple decades.

History rarely “repeats” but our modern political dynamic rings rather familiar. Many of the tactics used by the leftists in Russia in the early 20th Century are being used today in the US. In fact, I would argue they are almost exactly the same and that a Bolshevik-style revolution is happening right now.

Interestingly, the Bolsheviks were a tiny minority within the Russian population. At their peak in 1917 they had only 400,000 "official" members. They were supported politically by an estimated 23% of the population, but that is still a small movement compared to the 150 million Russian citizens trying to live their lives from day to day.

Had Russian conservatives (nationalists, Christians and defenders of private property rights) stood up and acted en masse to stop the Bolsheviks early in 1917, their society could have avoided the full scale murder that would befall them from 1918 onward. They might not have aligned perfectly with their existing government, but the communist alternative was so much worse.

Instead, the conservatives waited until agents of the Cheka were at their doorstep, and by that time it was too late to effectively fight back. As Aleksandr Solzhenitsyn depressingly noted in his book “The Gulag Archipelago”, the majority of Russians stood against Soviet rule but they did not have the courage to take up arms when it mattered most. And so, a minority of militant communists were able to dominate a nation of hundreds of millions. As Solzhenitsyn warned:

“We didn’t love freedom enough. And even more – we had no awareness of the real situation…We purely and simply deserved everything that happened afterward.”

The communists, of course, did not achieve such success alone. As scholar Antony Sutton outlined with ample evidence in his book “Wall Street And The Bolshevik Revolution”, they enjoyed the financial and logistical backing of various global elites (from the Rockefellers to the Morgans to the Harrimans) through the course of the revolution and after their rise to power.

The purpose? To create the model for an atheist and relativistic authoritarian state. A system that the globalists intend to one day use to take over the entire world.

Their plan relies heavily on a lack of action by patriots. It could be a weakness, but the leftists have good reason to feel emboldened lately.

Civil War 2.0 has, in fact, already kicked off in the form of a well funded far-left insurrection much like what happened in 1917 Russia.

The lack of conservative organization in response has been less than impressive, and I’m here to give a warning: We are approaching the point of no return.

Activists are funded by a massive shell game of NGOs hidden behind other NGOs. They are coordinated by hidden online discord servers. They receive their orders and share information in the field through encrypted Signal chats. They are trained in agitation and disruption by anonymous online meet-ups run by covert activist coordinators. They have engaged in violent attacks on ICE agents on hundreds if not thousands of occasions and few of them are ever prosecuted. This is not the behavior of a grassroots protest movement, this is the behavior of an army of covert operatives with special protections.

It’s important to understand that the “protests” are actually a highly coordinated guerrilla campaign – These are not sincere citizens exercising their civil rights. For now their stated motivation is to stop deportations of illegal migrants, but this is just an excuse for their insurgency. If ICE stopped operations tomorrow, the paid activists would simply fabricate another rationale for tearing the country apart. Placating them will accomplish nothing.

They are hostile combatants trying to assert dominance and grow their numbers through posturing. Their goal is the destruction of the western world. This cannot be allowed.

The clear solution would be for the government to shut down hostile NGOs, however, these institutions are protected by corporate personhood and have the same constitutional rights as individual citizens. The process of investigating them and prosecuting them takes time – time we don’t have.

Even if Trump utilized the Insurrection Act and deployed the military, there are not enough troops to lock down more than a handful of US cities. Those people hoping that martial law will resolve the issue are kidding themselves. By extension, leftists stand to gain greater support: Martial law would represent proof to the rest of the world that the administration is indeed “fascist.”

The course of the war will not depend on government intervention, so don’t hold your breath waiting for effective enforcement. The reality is, most activist arrests end with them right back out on the street anyway. Their support apparatus has to be permanently removed, or THEY have to be permanently removed from the equation.

Everything will be decided by regular conservatives. If they organize in large numbers, if they create a funding apparatus to move people and supplies around the country quickly, and if they form proper leadership and training guidelines, then there might be a chance for peace simply by presenting a formidable deterrent. If not, at least the means to put down the insurgency will be available.

If conservatives stay at home and refuse to protect any piece of territory beyond their front gate, they will lose everything. It’s inevitable. The side that wants to win will always have an edge over the side that “just wants to be left alone.”

Protests will continue to spread to other cities using the same model we have seen recently in Minneapolis. NGOs will try to provoke more activist deaths at the hands of federal agents. The more the activists go unchecked by the general public the more emboldened they will become and the more their numbers will grow in the assumption that they are the majority.

In the event that the protests are stalled but the organizations are not crushed, activists will revert to assassinations and Weather Underground-style terror attacks until they demoralize the populace and gather strength again. The bottom line? If the political left is not made to truly FEAR consequences, they will not stop until they get their own Red Terror purge.

The end result is not going to be “balkanization.” That idea might have worked during the pandemic, but at this stage it’s far too late for a national divorce. The leftists will never allow conservatives to live in peace in red states. Letting blue cities rule over entire states of mostly red counties would only legitimize progressive extremists and hurt the conservative cause. This fight is for the entire country, not pieces of it.

It’s also not going to be a war of “factions”. This is prepper SHTF theory nonsense. The lines could not be more defined. The “false left/right paradigm” is a dead remnant of the Ron Paul era. It no longer exists, at least not where the bottom of the pyramid is concerned. The vast majority of progressives and Democrats are onboard with woke extremism. They’re onboard with the purge. They are loyal soldiers of globalism. Unity with them means enslavement.

Leftists, globalists and their allies are not going to discern between MAGA, libertarians and centrists. They will ultimately treat everyone as an enemy worthy of elimination.

They’re also not going to divide and in-fight the way some conservatives predict, at least not until they’ve gotten rid of us first.

In the end, the fate of the US and western civilization stands on the precarious shoulders of a conservative movement that has the means to fight, but not necessarily the will. They are forever waiting for the perfect Hollywood scenario in which they can defend themselves in good conscience in a fair fight where they are the clear and undeniable “good guy.” They are forever waiting for the perfect moment to rise up – A moment that will never come.

Patriots have also planned and trained for decades under the pretenses that conservatives would be the insurgents, not the counter-insurgency. Counter-insurgency is much more difficult and requires far more resources. But guess what? You don’t always get to choose the wars you fight. Sometimes the war chooses you and you have to adapt.

There are certainly individuals who will do what they can. I will be among them as will many of the people I know.

But the great question, the great unknown, the unpredictable factor is whether or not average Americans will step off their porches in large numbers and send a clear message that they will no longer tolerate the chaos.

* * *

If you would like to support the work that Alt-Market does while also receiving content on advanced tactics for defeating the globalist agenda, subscribe to our exclusive newsletter The Wild Bunch Dispatch. Learn more about it HERE.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of ZeroHedge.

Tyler Durden

Mon, 02/02/2026 - 23:25

Jigar Shah attends the 2024 TIME100 Gala (Dimitrios Kambouris/Getty Images for TIME)

Jigar Shah attends the 2024 TIME100 Gala (Dimitrios Kambouris/Getty Images for TIME)

Palestinians bury war dead in a mass grave (via Egypt Today)

Palestinians bury war dead in a mass grave (via Egypt Today) Palestinians carry the bodies of children killed by an IDF strike on a shelter in Gaza City (Hadi Daoud / APA Images)

Palestinians carry the bodies of children killed by an IDF strike on a shelter in Gaza City (Hadi Daoud / APA Images) Israel’s heavy use of 2,000-pound bombs in densely-populated areas — something Western militaries avoid — has figured heavily in Gaza’s enormous death toll (Reuters)

Israel’s heavy use of 2,000-pound bombs in densely-populated areas — something Western militaries avoid — has figured heavily in Gaza’s enormous death toll (Reuters)

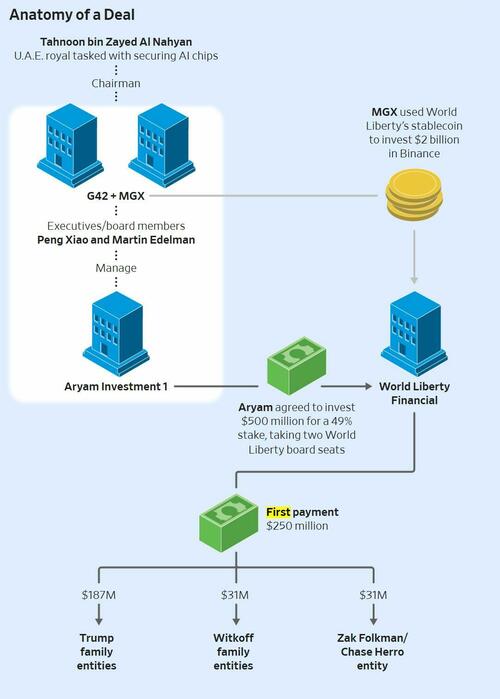

Anatomy of the deal. Source: WSJ

Anatomy of the deal. Source: WSJ

Adrian Alexander Conejo Arias, the father of Liam Ramos, left, is being detained with his son in Texas after being arrested by federal immigration authorities. (Obtained by Columbia Heights Public Schools; Department of Homeland Security) via Fox News

Adrian Alexander Conejo Arias, the father of Liam Ramos, left, is being detained with his son in Texas after being arrested by federal immigration authorities. (Obtained by Columbia Heights Public Schools; Department of Homeland Security) via Fox News U.S. District Judge Fred Biery

U.S. District Judge Fred Biery

Recent comments