Feed aggregator

H.R. 4499, a bill to make technical amendments to update statutory references to provisions reclassified to title 34, United States Code, and to correct related technical errors

Gabbard Defends Presence At Fulton County Election Warrant Execution

Authored by Zachary Stieber via The Epoch Times,

National Intelligence Director Tulsi Gabbard on Feb. 2 defended her presence at a Fulton County elections office while FBI agents executed a search warrant there, saying President Donald Trump had requested that she go to the Georgia office and that she has the authority to take action related to election integrity and security.

“Interference in U.S. elections is a threat to our republic and a national security threat,” Gabbard said in a letter to members of Congress.

“The president and his administration are committed to safeguarding the integrity of U.S. elections to ensure that neither foreign nor domestic powers undermine the American people’s right to determine who our elected leaders are.”

She said that Trump tasked her office with taking appropriate action under the authority granted by Congress toward ensuring the integrity of elections, and specifically directed her to observe the execution of the warrant in Fulton County near Atlanta on Jan. 28.

She also said she facilitated a call in which Trump briefly thanked the agents for their work. Trump did not ask any questions during the call, and neither the president nor Gabbard issued directives, she said.

FBI officials previously described agents as executing a court-authorized warrant about a month after the Trump administration filed a lawsuit against the county seeking voting records from the 2020 presidential election. County officials have said the records were under seal and could not be produced absent a court order.

Trump has alleged that he lost in Georgia in 2020 because of election fraud.

Sen. Mark Warner (D-Va.) and Rep. Jim Himes (D-Conn.), top Democrats on congressional intelligence committees, in a Jan. 29 letter said Gabbard’s presence was “deeply concerning.”

“The intelligence community should be focused on foreign threats and, as you yourself have testified, when those intelligence authorities are turned inwards the results can be devastating for Americans privacy and civil liberties,” they wrote.

The lawmakers asked for Gabbard’s reasoning for attending the FBI operation and legal authorities for her involvement and that of other intelligence officials.

Rep. Raja Krishnamoorthi (D-Ill.) was among other critics of Gabbard’s actions.

“The seizure of ballots in Fulton County may trace back to Trump’s refusal to accept his 2020 loss, but the danger is forward-looking. Tulsi Gabbard has no legal role in domestic law enforcement, and the FBI should not be seizing ballots,” he said on social media on Feb. 1.

Gabbard said in response that personnel from the National Counterintelligence and Security Center traveled with her to Fulton County but were not present during the execution of the warrant. She said that she has not seen the warrant, which is under seal, or evidence submitted to the court by the Department of Justice.

She also said that to preserve the integrity of American elections, officials must determine whether there has been malign interference and whether election systems are vulnerable to future exploitation.

“Election security is a national security issue,” Gabbard wrote.

The National Security Act gives the Office of the Director of National Intelligence the authority to coordinate and integrate national intelligence, including intelligence related to elections, Gabbard said.

She promised that the office would not “irresponsibly share incomplete intelligence assessments” concerning election interference.

Joe Kent, director of the National Counterterrorism Center, said on X this week that Gabbard had found 2020 election fraud. Kent, who did not elaborate, later shared Gabbard’s letter to Warner and Himes.

Tyler Durden Tue, 02/03/2026 - 14:00S. 2235, Diesel Emissions Reduction Act of 2025

Kremlin Says India Hasn't Confirmed Oil Cutoff As Modi Govt Mute, Hasn't Ratified

The Kremlin on Tuesday pushed back on Trump's claims that India is preparing to cut off Russian oil purchases following his major Truth Social announcement of a new US-India trade deal that sharply reduces tariffs on Indian exports.

"So far, we haven't heard any statements from New Delhi on this matter," Kremlin spokesman Dmitry Peskov told reporters, signaling that Moscow has received no official confirmation from India in light of Trump's assertions.

via Reuters

via Reuters

Peskov said Moscow is still "carefully monitoring the news" around Trump's claims, on the heels of his "wonderful" phone call with India's Modi and the tariff relief.

Trump had announced the US will trim its punitive tariff on Indian imports to 18% after striking what he hailed as a new "trade deal” with Prime Minister Narendra Modi. Crucially it hinges on New Delhi having reportedly ended its purchases of Russian crude and swapping them for massive US energy and goods buys.

"Out of friendship and respect for Prime Minister Modi and, as per his request, effective immediately, we agreed to a Trade Deal between the United States and India, whereby the United States will charge a reduced Reciprocal Tariff, lowering it from 25% to 18%," Trump posted. "Our amazing relationship with India will be even stronger going forward."

And yet, 24 hours later and India's Foreign Ministry has also remained silent on the question of abandoning Russian oil.

Given all of this, and that the potential remains that Trump's statements were too out front and presumptuous in terms of anything India may have actually agreed to in a finalized way, Peskov additionally said that while Russia "respects" US-Indian relations, Moscow's priority remains its own "strategic partnership" with New Delhi.

"And we intend to continue to comprehensively develop our bilateral relations with New Delhi, which is exactly what we’re doing," he emphasized.

As recently as December, President Vladimir Putin said Russia was prepared to continue “uninterrupted shipments” of oil to India despite pressure from Washington.

Modi's learning from Trump's social media about how India will not buy Russian oil & details of US India trade deal (before any Indian announcement) is certainly a first...

Modiji has undoubtedly given many firsts to India. Learning from Trump’s X account about how India will not buy Russian oil & details of US India trade deal (before any Indian announcement) is certainly a first. Jai Modiji pic.twitter.com/Yt44xgcVeA

— Mahua Moitra (@MahuaMoitra) February 2, 2026

Perhaps Trump's statement was intentionally premature in order to build more leverage and pile the pressure on Modi? The 'devil is in the details' in terms of what was actually agreed to in the phone call. The coming days will likely tell.

* * *

Below is more commentary via Rabobank...

Trump also struck a trade deal with India, reducing reciprocal tariffs to 18% and dropping the additional 25% after claiming India would stop buying Russian oil in favor of Venezuelan, showing how geopolitics links up. This isn’t the FTA the EU just signed, but let’s see which proves more important over time: as a well-placed Indian source noted to me, there‘s no growth in Europe vs. the US.

The fact the US will insist on the same no-transshipment rules for Chinese goods that it has with other trade partners is a blow to Beijing; equally, it blows up European hopes of building a trade coalition without the US (and in India frictions will continue, i.e., the EU agreed on green tech collaboration with Delhi, but the US said it is going to sell it more coal). The defense component will also be key. Europe now has a strategic partnership with India in that regard, but national governments hold sway there: will they want to see their defense industries moved to South Asia(?) By contrast, the US is able to move faster, though we shall see what they are prepared to share with India. Delhi at least gets to play both sides off against the other.

Tyler Durden Tue, 02/03/2026 - 13:40H.R. 5490, Dismantle Foreign Scam Syndicates Act

EU Pushes Rare Earth Mineral Partnership With US To Cut China Reliance

The European Union plans to propose a new critical-minerals partnership with the United States, aimed at limiting China’s influence and strengthening shared supply chains, according to Bloomberg.

According to people familiar with the talks, the EU is ready to sign a memorandum of understanding that would create a “Strategic Partnership Roadmap” within three months. The goal is to coordinate efforts to secure key minerals needed for modern technologies and reduce reliance on China’s low-cost supplies, which currently give Beijing significant leverage.

Under the proposal, the EU and US would explore joint mining and processing projects, consider price-support systems, and develop safeguards against market manipulation and oversupply. The plan also calls for building more resilient supply networks between both sides.

Bloomberg reports that the draft agreement stresses respect for territorial integrity, an issue that gained importance after recent tensions linked to President Donald Trump’s comments about Greenland. The proposal arrives as Washington prepares to meet with allied countries to advance agreements that cut dependence on Chinese minerals.

While similar efforts by previous US administrations have had limited results, officials say this push reflects growing urgency after China imposed export controls on rare earths last year. Although some restrictions were eased following talks between Trump and Xi Jinping, US officials are now seeking faster progress.

Washington is also urging partners to adopt pricing mechanisms to protect Western producers from cheaper Chinese exports. When the US encouraged individual EU countries to sign bilateral deals, the European Commission pushed for a unified approach, receiving backing from member states to negotiate on their behalf.

Despite doubts about whether a comprehensive agreement can be reached quickly, the EU’s offer suggests negotiations are moving forward. The proposal aligns with US interest in stockpiling minerals, following Trump’s recent $12 billion stockpile initiative.

According to sources, the new draft centers on closer cooperation to strengthen supply chains, cut strategic dependencies, and improve resilience to disruptions, while also deepening industrial and economic ties through joint projects. It proposes mutual exemptions from certain export controls on critical raw materials and calls for expanded collaboration on research and innovation across the full supply chain. The plan also emphasizes sharing information on risks and market conditions, boosting transparency, and considering measures such as joint stockpiles or a coordinated response group. In addition, it outlines closer alignment on how both sides handle export restrictions involving third countries.

Recall, the Trump administration is preparing to launch a major initiative aimed at protecting US manufacturers from disruptions in the supply of critical minerals, committing about $12 billion in initial funding to build a strategic stockpile of essential materials. The project, known as Project Vault, is designed to reduce America’s dependence on China for rare earths and other strategically important metals. By creating a centralized reserve for civilian industries, officials hope to cushion companies against sudden shortages and sharp price swings that can disrupt production and strain finances.

More than a dozen major companies have joined Project Vault, including General Motors, Stellantis, Boeing, Corning, GE Vernova, and Google. Three large trading firms - Hartree Partners, Traxys North America, and Mercuria Energy - will handle sourcing and purchasing materials for the stockpile.

Tyler Durden Tue, 02/03/2026 - 13:00Novo Nordisk Shares Sink After Sales Outlook Misses As US GLP-1 Competition Intensifies

Novo Nordisk ADRs were clubbed like a baby seal around midday after the Danish drugmaker said in an early full-year outlook release that it expects sales to shrink 5% to 13% at constant exchange rates, far worse than the expected 1.3% decline Wall Street analysts had been expecting, according to Bloomberg consensus.

Here's a snapshot of the full year forecast (courtesy of Bloomberg):

-

Sees sales at constant exchange rates -5% to -13%, estimate -1.39% (Bloomberg Consensus)

-

Sees operating profit at constant FX -5% to -13%, estimate -3.12%

Novo's annual sales last declined in 2017 during an insulin price war in the US market. The Danish drugmaker faces a multi-front battle, with Eli Lilly's Zepbound gaining ever-larger market share in the US and continued pressure from copycat versions of Ozempic.

Trading was halted ahead of the report. When trading resumed, Novo's U.S.-listed shares plunged 13%, the largest intra-day decline since -21% on July 29, 2025.

Since Novo ADRs peaked around $145 in mid-2024, shares have been locked in a vicious bear market, down about 64% from the highs.

Hopes for a turnaround emerged late last year (read here), but those expectations have since been erased after today's dismal outlook.

Last week, Goldman analyst Faris Mourad told clients that "obesity drugs narrative sentiment is on the rise" and "it's an opportunity to buy the dip."

More here on Mourad's call urging clients to buy into beaten-down obesity drug stocks.

And Goldman's long-time Novo bull, analyst James Quigley, is out with his first take on earnings, writing:

"At the time of writing, the Novo ADR was -14.5%, tomorrow morning we would expect the Novo shares to react broadly in line with the implied FY26 operating cuts of c.9%, as FY26 is a re-set year with respect to the pricing aspect of the GLP-1 market."

Perhaps it's time for Quigley to just give up on Novo...

Tyler Durden Tue, 02/03/2026 - 12:45US Shoots Down Iranian Drone In 'Self-Defense' In Gulf Waters

Update (1243ET):

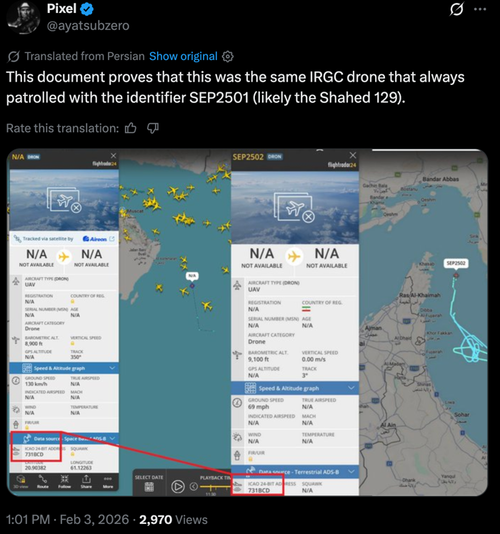

A highly dangerous direct first encounter between Iranian and US forces operating in close proximity in the Persian Gulf region, as an Iranian drone has been downed:

- US F-35 WARPLANE SHOT DOWN DRONE IN SELF-DEFENSE: CENTCOM

"USS Abraham Lincoln (CVN 72) was transiting the Arabian Sea approximately 500 miles from Iran's southern coast when an Iranian Shahed-139 drone unnecessarily maneuvered toward the ship. The Iranian drone continued to fly toward the ship despite de-escalatory measures taken by US forces operating in international waters," US Central Command (CENTCOM) Spokesman Capt. Tim Hawkins said.

An F-35C fighter jet launched from the carrier shot down the drone in self-defense to protect the vessel and its crew, Hawkins claimed in the official explanation. There were no reports of injuries.

There's as yet no account of the incident from the Iranian side, at a moment the Islamic Republic has said its "finger is on the trigger" while awaiting a potential Trump decision for military action. This event alone could derail the expected Friday nuclear talks hosted by Turkey.

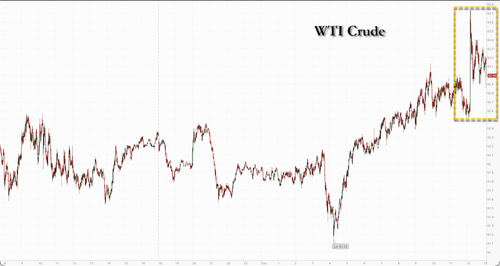

In energy markets, WTI futures briefly spiked into $63/bbl handle and have since retreated to $62/bbl.

Headlines from White House press secretary Karoline Leavitt:

-

CENTCOM ACTED APPROPRIATELY TO SHOOT DOWN IRAN DRONE

-

IRANIAN DRONE WAS UNMANNED

The comment above was enough to hit oil after the spike...

Here is what one X slueth is saying (read thread).

* * *

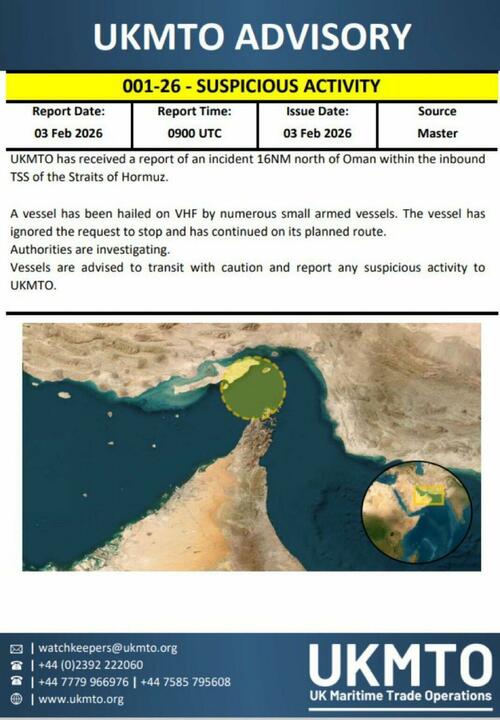

UK Maritime Trade Operations warned of a "suspicious activity" on Tuesday morning at the Strait of Hormuz, the world's most critical energy chokepoint, after numerous small armed boats attempted to stop a U.S. oil tanker.

This is what UKMTO has reported so far:

Location: about 16 nautical miles north of Oman, within the inbound traffic separation scheme

Incident: a merchant vessel was hailed on VHF by multiple small armed boats

Response: the vessel ignored requests to stop and continued on its planned route

Status: authorities are investigating

Guidance: all vessels are advised to transit with caution and report any suspicious activity to UKMTO

Here's the UKMTO Advisory:

The Wall Street Journal provided more color on the situation, including the U.S. tanker:

Maritime-security firm Vanguard Tech said in a message to clients that six Iranian gunboats armed with 50-caliber guns approached the tanker as it entered the strategic waterway and ordered it to kill the engines and prepare to be boarded. Instead, the vessel sped up and was later escorted by a U.S. warship.

U.S. officials confirmed armed Iranian boats tried to stop a U.S.-flagged ship and that it was escorted to safety.

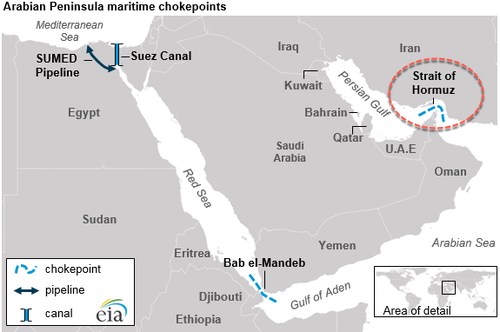

The incident occurred at the critical maritime chokepoint where 20% of oil trade and a large share of LNG flows pass daily.

At its narrowest, shipping lanes are only about 2 miles wide in each direction...

Brent crude prices are marginally higher on the session, trading around $66/bbl handle.

UBS analyst Dominic Ellis provided clients with his assessment of the crude oil market early Tuesday: "The Lowdown: Oil At Risk Of Near-Term Pullback But Risks Remain."

Ellis continued:

In the near term, UBS strategists are expecting a pullback in oil, which is running ahead of their assumptions for the quarter and the year. They see the market as oversupplied this quarter and in the full year, which should pull Brent back down into the low $60s. It is now in the mid $60s having touched low $70s very recently.

What is challenging their view is that the U.S. is building up a presence in the Middle East, and there is a perceived risk of direct intervention in Iran, which could impact Iranian supply and potentially if things spill over into the wider region, affect the 20% of global crude flows that pass through the Strait of Hormuz.

Brent crude prices...

US-Iran tensions appear to be simmering down:

This comes as the U.S. has been building up naval forces in the region for a possible strike on Iran.

Tyler Durden Tue, 02/03/2026 - 12:43Watch: Viral Video Exposes Democrats' Staggering Hypocrisy On Immigration Enforcement

Authored by Steve Watson via Modernity.news,

A viral video compilation circulating on X has laid bare the dramatic reversal in Democratic positions on immigration, showcasing top party figures advocating for robust border security measures that they now vehemently oppose.

This shift comes amid growing public demand for deportations, exposing a calculated pivot away from policies that once aligned with American interests.

The video, posted by @WesternLensman on X, features archived clips of prominent Democrats articulating views on immigration that echo today’s America First agenda. It underscores how border security was once a bipartisan consensus before the party’s radical elements took over.

NEW VIDEO: For decades, border security and immigration enforcement weren’t controversial or radical ideas.

— Western Lensman (@WesternLensman) February 2, 2026

The only thing that changed?

Democrats. pic.twitter.com/h1MHLdRIn3

In one clip, former President Barack Obama states, “Americans are right to demand better border security and better enforcement of the immigration laws.”

Obama continues in another segment: “We simply cannot allow people to pour into the United States undetected, undocumented, unchecked.”

He adds, “We’ve had five million undocumented workers come over the borders. It has become an extraordinary problem.”

Former President Bill Clinton echoes this sentiment: “All Americans not only in the states most heavily affected but in every place in this country are rightly disturbed by the large numbers of illegal aliens entering our country.”

Clinton asserts, “And we must do more to stop it.”

Joe Biden, in an older clip, is asked, “Yes or no, would you allow sanctuary cities to ignore the federal law?”

He responds, “No. Any city should listen to the Department of Homeland Security.”

Hillary Clinton criticizes sanctuary policies: “The city made a mistake not to deport someone that the federal government strongly felt should be deported.”

Clinton also says, “Just because your child gets across the border, that doesn’t mean the child gets to stay.”

She further declares, “We do not think the comprehensive health care benefits should be extended to those who are undocumented workers and illegal aliens.”

Clinton emphasizes, “We do not want to do anything to encourage more illegal immigration.”

Senate Majority Leader Chuck Schumer explains, “People say, well why can’t you stop illegal immigrants from coming here? And the number one answer we give is when they come here they can get jobs, get benefits against the law because of fraud.”

Schumer states plainly, “Illegal immigration is wrong, plain and simple,” further warning “Open borders, you’re doing away with a concept of nation state.”

Senator Bernie Sanders affirms, “Our nation like all nations has the right and obligation to control its borders.”

Finally, Obama reinforces accountability: “No matter how decent they are, no matter their reasons, 11 million who broke these laws should be held accountable.”

This compilation arrives as Democrats ramp up efforts to undermine ICE and DHS operations. Recent reports highlight Senate Democrats threatening to block government funding over demands for reforms to immigration enforcement following incidents in Minneapolis, including fatal shootings by federal agents. They seek measures like requiring warrants for arrests and ending roving patrols, moves that would hamstring border security.

Such positions mark a stark departure from their earlier stances, prioritizing open borders and globalist priorities over national sovereignty.

This hypocrisy is all the more glaring given the overwhelming public support for mass deportations. As we previously reported, multiple polls confirm that 55% to 64% of Americans favor deporting all illegal immigrants, with sentiments hardening against unchecked influxes.

The video serves as a potent reminder that secure borders were once uncontroversial—until Democrats decided otherwise to chase votes and advance agendas that erode American communities.

With President Trump poised to ramp up enforcement, these past admissions from Democratic leaders only strengthen the case for restoring law and order at the border, putting America first once more.

Your support is crucial in helping us defeat mass censorship. Please consider donating via Locals or check out our unique merch. Follow us on X @ModernityNews.

Tyler Durden Tue, 02/03/2026 - 12:25'SaaSpocalypse' Strikes As Private Credit-Software Stock Vicious Cycle Accelerates

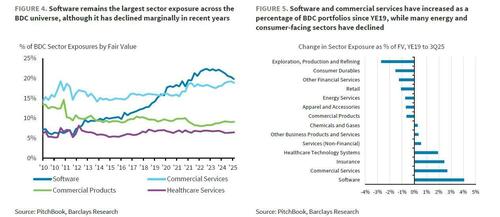

Yesterday, in a must read report for everyone, we highlighted the shocking reality of the circular firing squad evolving between private credit providers (BDCs) and software companies as the latter suffers from artificial intelligence's domination and the former's pain grows from the massive exposure it faces to those very same software entities.

“Software is the largest sector exposure for BDCs, at around 20% of portfolios, making the industry particularly sensitive to the recent decline in software equity and credit valuations,” Barclays analysts including Peter Troisi wrote in a note available to pro subs.

The total exposure was about $100 billion in the third quarter of last year, the analysts said, citing PitchBook data.

Today the vicious cycle is accelerating as the details of the report hit the mainstream with Bloomberg reporting that sentiment has gone from bearish to doomsday lately with traders dumping shares of companies across the industry as fears about the destruction to be wrought by artificial intelligence pile up.

“We call it the ‘SaaSpocalypse,’ an apocalypse for software-as-a-service stocks,” said Jeffrey Favuzza, who works on the equity trading desk at Jefferies.

“Trading is very much ‘get me out’ style selling.”

The anxiety was underscored Tuesday after AI startup Anthropic released a productivity tool for in-house lawyers, sending shares of legal software and publishing firms tumbling.

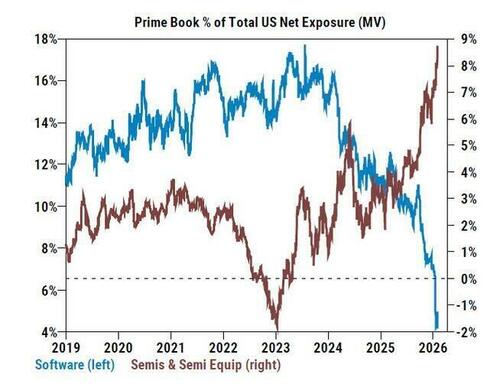

Hedge funds have already been exiting the 'software' building en masse, as noted over the weekend, Goldman's Prime Brokerage showed a stunning chart: the divergence between hedge fund exposure in semiconductor companies (broadly seen as beneficiaries of the AI supercycle) and software companies (increasingly seen as the biggest losers of AI), has never been greater.

It appears that the rest of the market is now waking up to that pain trade.

Goldman Sachs Software stock basket is collapsing, now back near Liberation Day lows from last year...

Perceived risks to the software industry have been simmering for months, with the January release of the Claude Cowork tool from Anthropic supercharging disruption fears.

“I ask clients, ‘what’s your hold-your-nose level?’ and even with all the capitulation, I haven’t heard any conviction on where that is,” Favuzza said.

“People are just selling everything and don’t care about the price.”

All told, the S&P North American software index is on a three-week losing streak that pushed it to a 15% drop in January, its biggest monthly decline since October 2008.

Simply put, fears of an AI-induced wave of obsolescence have left investors wondering which industries will be left behind.

“The draconian view is that software will be the next print media or department stores, in terms of their prospects,” said Favuzza at Jefferies.

“That the pendulum has swung so far to the sell-everything side suggests there will be super-attractive opportunities that come out of this. However, we’re all waiting for an acceleration, and when I look out to 2026 or 2027 numbers, it is hard to see the upside. If Microsoft is struggling, imagine how bad it could be for companies more in the path of disruption, or without its dominant position.”

FactSet notes that 75% of companies have beat on EPS and 65% beat on revenue. That’s not great by hit-rate standards.

Instead, as Bloomberg reports, the lift is coming from magnitude - fewer companies are clearing the bar, but the ones that do are clearing it by enough to keep the aggregate results looking healthy.

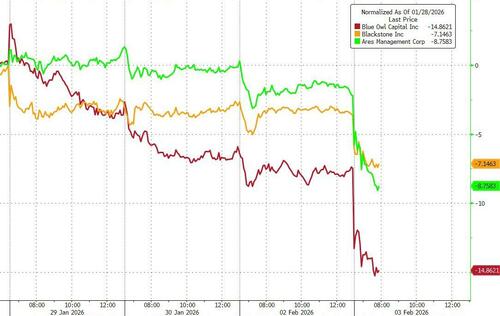

But, as we noted in detail previously, and briefly at the start of this note, the pain in software is not staying there as BDCs are suffering significantly.

Private credit could see default rates surge to as high as 13% in the US if artificial intelligence triggers an “aggressive” disruption among corporate borrowers, UBS Group AG strategists wrote in a separate note on Monday.

And today we see that fear contagiously accelerate in the BDCs, including Blue Owl, Blackstone, and Ares...

The central issue facing investors who want to buy software stocks is separating the AI winners from the losers. Clearly, some of these companies are going to thrive, meaning their stocks are effectively on sale after the recent rout. But it may be too early to determine who they are.

“The fear with AI is that there’s more competition, more pricing pressure, and that their competitive moats have gotten shallower, meaning they could be easier to replace with AI,” said Thomas Shipp, head of equity research at LPL Financial, which has $2.4 trillion in brokerage and advisory assets.

“The range of outcomes for their growth has gotten wider, which means it’s harder to assign fair valuations or see what looks cheap.”

For now, traders are selling first as the threat of falling software equity prices prompts painful balance sheet reflection at private credit shops (which don't report until late Fed/early March), triggering less availability of credit (or pulling existing lines), feeding back into lower growth potential for software companies (which already face existential threats from AI).

Much more on this whole fiasco in the full Barclays note available to pro subs.

Tyler Durden Tue, 02/03/2026 - 12:10Heavy Metal(s) And Concepts

By Michael Every of Rabobank

Markets have shrugged off heavy metal(s) even though their plunge Friday was staggering. We are up around 5% in gold this morning following reports of queues of Singaporeans buying the dip yesterday. Yet note that this happened to an asset seen as a “safe-haven”, and as the foundation of a new global system - even as nobody anywhere is close to demanding gold as payment for exports, or is able to do so if needed. Indeed, there are whispers that a key driver of, and much of the worst damage from, the pump-‘n’-dump was centered in China (whose neo-mercantilism is ironically a key reason for fractures in fiat currency and the liberal world order). One wonders how long generic ‘markets’ can stay calm in a world in which so many people are so unenamoured of fiat FX; and how metals can cope with “because markets!” HFT speculation that make them trade like an NFT or meme stock.

Then again, markets seem to have put the extraordinary recent volatility in JGBs behind them when nothing has been resolved there. PM Takaichi seems set for a landslide victory on 8 February that will lead us back to where we were - save the US suggesting there’s no bailout from it coming for Japan. That leaves the world’s third largest economy, the $7.8 trillion JGB market, and JPY all on edge as Tokyo deals with rising geopolitical tensions with China over Taiwan.

Going back to Friday, a meme is that metals were heavy as Fed Chair nominee Warsh was seen as a hawk: yet there’s as much likelihood of that being true as that he was picked for his looks. US rates are going to fall, but Warsh just looks hawkish. Moreover, a hawk/dove framing is arguably now irrelevant. What I dub ‘reverse perestroika’ implies a shift to a Treasury- not Fed-centric system and to industry from financialisation: logically that implies different interest rates by sector, so hawkish and dovish. As @mnicoletos puts it, it means changes to encourage banks to lend more into productive sectors. And as @ctindale points out, it requires abandoning abstract economist models of aggregate supply and demand -- useless vs shocks like rare earths -- to address specific material constraints in each sector, e.g., funding stockpiles to release rather than raising rates. If Warsh wants a ‘regime change’ at the Fed (as do Bessent and Trump), then that’s the form it will take, comrades, not just ‘hawk/dove’.

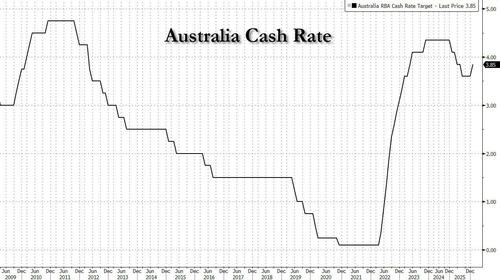

That’s too late for those who ended up having to raise rates after cutting them, i.e., the RBA. Australia’s property-addled economy and Reserve Bank are the first to U-turn on “because (property) markets” rate cuts, hiking to 3.85%, because of “materially” higher inflation, rather than the low inflation their abstract model had told them was looming. It looks like another hike is also going to have to follow. As the Aussie financial press put it, “Chalmers and Bullock both messed up on inflation – the RBA is finally trying to fix its inflation mistakes. When will the federal government follow suit?” Equally, when will abstract models follow suit? And when will markets grasp that is what logically follows on from all of this?

Oil slumped 4.5% Monday on the view Iranian threats of regional war are overblown. The US and Iran will talk Friday, yet the US wants a deal to end its nuclear program, which it bombed last year, and its ballistic missile program and support for terrorist proxies; Iran may float handing over enriched uranium, but says it will only act within its “national interests.” Don’t just read the financial press: follow the logistical build-up of US military power; consider reports Trump favors regime change following as many as 30,000 Iranian protestor deaths; and see there is no geostrategic logic in the US moving weapons into place then allowing Iran to carry on (including selling oil to China).

That’s also as the START US-Russia arms control agreement STOPS on Thursday, kick-starting a new nuclear arms race. Europe might have to join this time. In which case, the politics are very complex --as Draghi called for an EU “federation” to avoid being “picked off one by one” by the US and China-- and as a nuclear trifecta could cost from hundreds of billions to a trillion euros. Add it to the Strategic Autonomy bill, as Europe finds that: it’s struggling to coordinate defence efforts; even replacing the US-backed internal communication system for defence data will take until at least 2030; and as it was warned that its efforts to diversify critical minerals supplies have “incomplete foundations” due to their “nonbinding” targets.

By contrast, President Trump will launch Project Vault --$12bn in seed capital, $1.7bn private, the rest from a 15-year US Export-Import Bank loan-- to build a US strategic critical minerals stockpile. This is separate from the Pentagon’s and is for the civilian economy. The intention is to insulate it from wild price swings in key inputs --something China has long done for key goods, but which the West has eschewed because of its brilliant intellectual conceit of “because markets” as the answer to everything -- as well as economic coercion - which China has again been able to threaten in rare earths “because markets.”

Trump also struck a trade deal with India, reducing reciprocal tariffs to 18% and dropping the additional 25% after claiming India would stop buying Russian oil in favor of Venezuelan, showing how geopolitics links up. This isn’t the FTA the EU just signed, but let’s see which proves more important over time: as a well-placed Indian source noted to me, there‘s no growth in Europe vs. the US. The fact the US will insist on the same no-transshipment rules for Chinese goods that it has with other trade partners is a blow to Beijing; equally, it blows up European hopes of building a trade coalition without the US (and in India frictions will continue, i.e., the EU agreed on green tech collaboration with Delhi, but the US said it is going to sell it more coal). The defense component will also be key. Europe now has a strategic partnership with India in that regard, but national governments hold sway there: will they want to see their defense industries moved to South Asia(?) By contrast, the US is able to move faster, though we shall see what they are prepared to share with India. Delhi at least gets to play both sides off against the other.

Tyler Durden Tue, 02/03/2026 - 11:10H.R. 3495, Direct Seller and Real Estate Agent Harmonization Act

House To Vote On Package To End Partial Shutdown

The U.S. House of Representatives on Tuesday will take up a bill to fund several sectors of the federal government as a partial shutdown enters its fourth day.

Many Democrats - including leaders - have vowed to withhold support from the package.

On Monday evening, the House Committee on Rules advanced the measure - which would fully fund five sectors of the government while extending funding for the Department of Homeland Security (DHS) until Jan. 13 - in a party-line 8–4 vote following a more than four-hour committee hearing.

As Jopseph Lord and Nathan Worcester report for The Epoch Times, with Democratic leaders indicating that they won’t give their backing to the measure, House Speaker Mike Johnson (R-La.) will need to rely mostly on his narrow Republican majority to pass the measure.

In a full vote of the House, Johnson can spare only one defection in a party-line vote, though some Democrats are expected to back the measure.

However, some issues with the Senate proposal could lead Republicans to oppose the measure.

Rep. Thomas Massie (R-Ky.), a longtime budget hawk and a particular opponent of the Cybersecurity and Infrastructure Security Agency (CISA), which falls under DHS, voted against the previous funding measure due to its funding for CISA, and could oppose the stopgap measure as well.

Other Republicans have pushed leadership to attach the Safeguarding American Voter Eligibility (SAVE) Act to the measure.

Leadership has resisted these demands, which Senate Minority Leader Chuck Schumer (D-N.Y.) says would make the bill dead on arrival in the upper chamber. The bill reported out of the Rules Committee didn’t include the SAVE Act.

Nevertheless, the passage of the legislation through the Rules Committee—which includes conservative skeptics of the bill such as Reps. Ralph Norman (R-S.C.) and Chip Roy (R-Texas)—is a good sign for Republican leaders on the funding package’s prospects.

House Majority Leader Steve Scalise (R-La.) downplayed the difficulties in comments to reporters on Monday.

“They all come down to the wire, and then we get our business done,” Scalise said.

The bill at issue would provide full-year funding for the departments of Defense, Labor, Health and Human Services, Education, Transportation, and Housing and Urban Development.

Democrats are demanding reforms to DHS and its subsidiary immigration enforcement agencies before they’ll support a full-year funding measure, though many House Democrats—including leadership—have expressed opposition to extending DHS funding at all before these reforms are addressed.

Rules Committee Ranking Member Jim McGovern (D-Mass.), meanwhile, voiced opposition to the measure at the hearing.

“I will not vote for business as usual while masked agents break into people’s homes without a judicial warrant, in violation of the Fourth Amendment,” he said, referencing ongoing disputes related to the executive branch’s use of self-issued administrative warrants, rather than court-issued judicial warrants, to enter homes.

However, one Democrat—House Appropriations Committee Chairwoman Rosa DeLauro (D-Conn.)—indicated at the hearing that she would break with her party to back the measure.

“I will support this package,” DeLauro said at the hearing, referencing the five full-year funding bills attached to the package that have Democratic support.

She said that without the funding extension for DHS, Democrats “won’t be able to bring the kinds of pressure” needed to add reforms to the full-year DHS funding package.

McGovern explained his opposition in response to a question from The Epoch Times outside the hearing room.

“Personally, [I] cannot bring myself to go for one more cent for ICE without some serious guardrails put in place, and I think the leverage we have is now more so than two weeks from now,” McGovern said.

Johnson has said he is “confident” that the partial shutdown will end with the Tuesday vote, despite indicating that House Democrats haven’t given their support to pass the Senate-passed measure.

“We have a logistical challenge of getting everyone in town, and because of the conversation I had with Hakeem Jeffries, I know that we’ve got to pass a rule and probably do this mostly on our own,” Johnson told NBC News’s “Meet the Press.”

House Democratic leadership has not indicated support for the measure publicly, despite it having been backed by Schumer and other Senate Democrats.

House Minority Leader Hakeem Jeffries (D-N.Y.) told ABC’s “This Week” that it’s clear that the “Department of Homeland Security needs to be dramatically reformed.”

“Masks should come off,” he said. “Judicial warrants should absolutely be required consistent with the Constitution, in our view, before DHS agents or ICE agents are breaking into the homes of the American people or ripping people out of their cars.”

Tyler Durden Tue, 02/03/2026 - 10:55H.R. 3307, Eastern Mediterranean Gateway Act

S. 2169, Rural Hospital Cybersecurity Enhancement Act

'Turnaround Tuesday'?: FundStrat's Lee Says "All The Pieces Are In Place For Crypto To Be Bottoming"

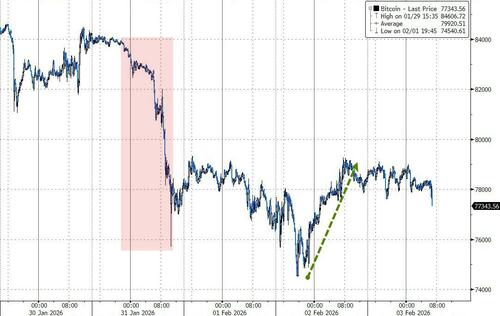

Bitcoin remains under pressure this morning, stalling after a brief rebound from a 10-month low as trader caution persisted in options activity.

Trading was mostly flat, with the biggest cryptocurrency hovering below $78,500 a day after bearish sentiment nearly pushed it to the lowest level since President Trump returned to the White House just over a year ago.

The Bear Traps Report's Larry McDonald laid out the following as some of the reasons for the relentless decline in Bitcoin?

-

We know that Oct 10 (Billions $$ lost overnight in crypto) was a pivotal moment when some glitches Binance triggered a sell-off, exacerbated by Trump's tariff tweet that day (100% on China) and MSCI reviewing DAT company eligibility (MSTR, etc.).

-

Also during Q4, bitcoin suffered from market makers deleveraging, the government shutdown, and the liquidity drain (overnight funding stress), which forced the Fed to restart QE in Dec.

-

Late in Q4 Mt Gox started to sell again. They still have about 40K bitcoin that they periodically sell, but anytime they show up, it weighs on bitcoin.

-

The cold spell in mid-January forced a lot of bitcoin miners offline to preserve electricity. This led to a drop in the hash rate, which also put pressure on prices.

-

Also in January, it became clear that the CLARITY Act (pro bitcoin) was going to be delayed because Trump wants to prioritize housing affordability first. So all the pumpers trying to front-run legislation just got carted off the field.

-

Simultaneously, bank excess reserves started to bleed lower again as Bessent filled up the TGA to prepare for big tax refunds in Q1 and the Fed was slow to expand its balance sheet in January.

-

More recently, the appointment of Warsh as Fed chair has triggered a plunge in precious metals on concerns of balance sheet contraction, and this selloff spilled over on bitcoin as well.

However, amid all that, CoinTelegraph reports that market and derivatives data suggests Bitcoin may find support around YTD lows...

1. Resilience in Bitcoin derivatives suggests that professional traders have refused to turn bearish despite the 40.8% price decline from the $126,220 all-time high reached in October 2025. Periods of excessive demand for bearish positions typically trigger an inversion in Bitcoin futures, meaning those contracts trade below spot market prices.

Bitcoin 2-month futures basis rate. Source: Laevitas.ch

The Bitcoin futures annualized premium (basis rate) stood at 3% on Monday, signaling weak demand for leveraged bullish positions. Under neutral conditions, the indicator usually ranges between 5% and 10% to compensate for the longer settlement period.

2. Even so, there are no signs of stress in BTC derivatives markets, as aggregate futures open interest remains healthy at $40 billion, down 10% over the past 30 days.

“The BTC options market is showing signs of stabilizing as extreme downside fear begins to mean-revert,” said Sean McNulty, APAC derivatives trading lead at FalconX.

“However, a weekly close below $75,000 would invalidate the current bounce higher, and potentially open a vacuum toward that $69,000 to $70,000 zone.”

3. Traders grew increasingly concerned after spot Bitcoin exchange-traded funds (ETFs) recorded $3.2 billion in net outflows since Jan. 16. Even so, the figure represents less than 3% of the products’ assets under management. Additionally, after 10 straight days of outflows, BTC ETFs saw a large $561mm inflow yesterday...

Bitcoin US-listed spot ETFs daily net flows, USD

“For crypto specifically, ETF flow stabilization is the key signal to monitor,” said Timothy Misir, head of research at digital asset analytics firm BRN.

4. Strategy (MSTR US) also fell victim to unfounded speculation after its shares traded below net asset value, fueling fears that the company would sell some of its Bitcoin.

Beyond the absence of covenants that would force liquidation below a specific Bitcoin price, Strategy announced $1.44 billion in cash reserves in December 2025 to cover dividend and interest obligations. MSTR announces earnings on Thursday, so that could be a trigger for better or worse.

Bitcoin’s price may remain under pressure as traders try to pinpoint the drivers behind the recent sell-off, but there are strong indications that the $75,000 support level may hold.

“Turnaround Tuesday seems to be in effect,” said Jeff Anderson, head of Asia at STS Digital.

“Markets got over their skis selling risk assets, and now that everyone has calmed down a bit, things rally off the lows.”

Fundstrat Global Advisors’ Tom Lee is sounding a cautious yet optimistic note for crypto investors, arguing that recent turbulence in Bitcoin and Ethereum may be temporary.

“Investors appear more selective, waiting for clearer signals on macro conditions, liquidity, and whether Bitcoin can sustainably hold above prior highs before adding exposure,” said Sean Rose at digital-asset data firm Glassnode about flows and investor appetite.

“A similar slowdown in accumulation momentum among public and private companies reinforces this pattern.”

Despite near-term headwinds, Lee sees signals that crypto may be bottoming. Fundstrat advisor Tom DeMark believes “time and price” alignment has been reached, with Bitcoin back above $78,000 and Ethereum nearing $2,300.

Today @Fundstrat's Tom Lee on @CNBC: “All the pieces are in place for crypto to be bottoming right now"

— FS Insight (@fs_insight) February 2, 2026

Access Tom Lee’s market views and outlook with a 30-day free trial of premium Fundstrat research: https://t.co/sX6DE4NjMP pic.twitter.com/XscZBQLxGb

“All the pieces are in place for crypto to be bottoming right now,” he said, contrasting price weakness with network activity, confirming what Goldman pointed out yesterday, that in contrast to the declining price performance, on-chain activity painted a different picture, especially for the Ethereum and Solana networks.

Tyler Durden Tue, 02/03/2026 - 10:40

Mandelson Resigns From House Of Lords Over 'Embarrassing' Epstein Scandal

Update(1023ET): One welcome immediate repercussion to the fresh Epstein dump of millions of files is that things have finally started happening in terms of a real domino effect in elite circles...

Lord Mandelson, ex-ambassador to U.S., resigns from Labour over Epstein.

Still, all of this might be happening slower than what one might want to see, but it's something when for example NPR is actually doing segments on the Epstein scandals surrounding Bill Gates and others, for example.

On Mandelson, to review one key aspect to what we detail below, he gave Jeffrey Epstein advance notice of a €500bn bailout to save the Euro, messaging Epstein about the bailout on the evening of May 9, 2010 - after which it was formally announced the following morning.

Then Labour's Business Secretary had forwarded No. 10 documents on economic assessments, asset sales, an EU bailout tip - among other interactions with his "pal". To review, something big was expected amid the "embarrassing" scandal and confirmation of corrupt insider wrongdoing:

By Sunday, a shocked Mandelson (he was not expecting the release) has quit the Labour party, citing a desire to prevent “further embarrassment”. Labour says that disciplinary action was already “under way”. By phone that night, the grandson of the party grandee Herbert Morrison tells me of his decision it “wasn’t easy”, but he feels “better for it as I need to reset”.

His resignation might be the start of further legal action, as MPs are already lobbying that he never be able to return to government or positions of power:

Baroness Harriet Harman, who was leader of the Commons when Lord Mandelson was business secretary, says Mandelson has "cast a stain over not just this government, but over politics as a whole".

She tells BBC Radio 4's Today programme: "I'm sure the government are in absolutely no doubt about the seriousness of it, and will be taking action and Peter Mandelson will be held accountable."

* * *

Former U.K. Cabinet minister Peter Mandelson - who was fired last September from his new role as ambassador to the United States due to his ties to Jeffrey Epstein - is facing mounting political and legal pressure following disclosures that he may have shared market-sensitive government information with Epstein during the global financial crisis.

Keir Starmer, right, with Peter Mandelson, left. The prime minister is likely to face renewed questions over his judgment in appointing Mandelson as US ambassador.

Keir Starmer, right, with Peter Mandelson, left. The prime minister is likely to face renewed questions over his judgment in appointing Mandelson as US ambassador.

Documents released Friday by the U.S. Department of Justice as part of the so-called Epstein files appear to show that Mandelson, then business secretary in the Labour government of Prime Minister Gordon Brown, forwarded confidential policy discussions and draft plans to the disgraced financier while the government was grappling with the collapse of global credit markets.

As the Guardian notes, emails forwarded to Epstein from the very top of the UK government include:

- A confidential UK government document outlining £20bn in asset sales.

- Mandelson claiming he was “trying hard” to change government policy on bankers’ bonuses.

- An imminent bailout package for the euro the day before it was announced in 2010.

- A suggestion that the JPMorgan boss “mildly threaten” the chancellor.

- Epstein asked Mandelson to confirm a €500bn bailout – which the then business secretary said would be announced that evening. The following day, Mandelson also appeared to give Epstein an early tipoff about Gordon Brown’s resignation.

The revelations have prompted Prime Minister Keir Starmer to order an investigation by the cabinet secretary and to demand that Mandelson resign from the House of Lords. Brown has separately asked the cabinet secretary, Chris Wormald, to investigate the alleged disclosures.

Opposition parties have escalated the matter further. The Scottish National Party and Reform UK have reported Mandelson to police, alleging misconduct in a public office. Emily Thornberry, Labour’s chair of the foreign affairs select committee, said the allegations should be examined as a potential criminal matter.

The Metropolitan Police confirmed it had received several reports relating to alleged misconduct and was assessing whether they meet the threshold for a criminal investigation.

“The reports will all be reviewed to determine if they meet the criminal threshold for investigation,” said Commander Ella Marriott. “As with any matter, if new and relevant information is brought to our attention we will assess it, and investigate as appropriate.”

Sensitive Information SharedAccording to the disclosures, emails forwarded to Epstein from senior levels of the British government included a confidential document outlining £20 billion in potential asset sales, discussions about changing policy on bankers’ bonuses, details of an imminent eurozone bailout package ahead of its public announcement in 2010, and references to pressuring the chancellor through senior banking executives.

In one email sent on June 13, 2009, Nick Butler, then a special adviser to Brown, circulated a memo detailing policy measures under consideration and suggesting that the government had £20 billion in saleable assets. Mandelson forwarded the message to Epstein, writing, “Interesting note that’s gone to the PM.”

Epstein replied asking, “what salable (sic) assets?” A response from a redacted email address stated: “Land, property I guess.” Four months later, the government announced plans to sell surplus real estate in a bid to raise £16 billion.

Butler said he was considering reporting the matter to police. “We worked on the basis of trust, which allowed us to float ideas,” he told the Times. “I am disgusted by the breach of trust, presumably intended to give Epstein the chance to make money.”

Another email from May 9, 2010 shows Epstein asking Mandelson to confirm a €500 billion eurozone bailout, which Mandelson indicated would be announced that evening. The following day, Mandelson appeared to give Epstein advance notice of Brown’s impending resignation.

"he was a great FX trader" https://t.co/1U0adiK71z

— zerohedge (@zerohedge) February 2, 2026

In separate correspondence days later, Epstein asked whether JPMorgan chief Jamie Dimon should contact the chancellor, Alistair Darling. Mandelson replied that Dimon should “mildly threaten” him.

BBC economics editor Faisal Islam said he understood from discussions with Darling that such calls from senior bankers, including Dimon, did subsequently take place.

Financial Ties Under QuestionThe disclosures have also revived questions about Mandelson’s financial relationship with Epstein. Documents released earlier this week suggest that Epstein paid a total of $75,000 into bank accounts of which Mandelson, then a Labour MP, was believed to be a beneficiary. It is also alleged that Epstein sent £10,000 in September 2009 to Mandelson’s partner—now his husband—Reinaldo Avila da Silva, to help fund an osteopathy course and other expenses.

A former adviser described Mandelson’s conduct to the Guardian as “treacherous,” adding: “You can imagine the sense of betrayal that those of us who worked every hour of the day during that crisis are feeling.”

Brown said he had previously asked the cabinet secretary to investigate potential leaks in September but was told there was insufficient evidence at the time. “This is shocking new information that has come to light,” Brown said Monday, calling for “a wider and more intensive enquiry” into the disclosure of government papers during the crisis.

Political FalloutStarmer, who has no direct authority to strip Mandelson of his peerage, is facing renewed scrutiny over his decision to appoint Mandelson as U.S. ambassador and his proximity to senior Labour figures, including chief of staff Morgan McSweeney and Health Secretary Wes Streeting. Mandelson resigned his Labour Party membership on Sunday.

Downing Street has written to the House of Lords authorities urging urgent reform of disciplinary procedures to allow for the removal of peers in cases of serious misconduct. A Lords source said there is currently little guidance on how such reforms would be implemented, despite their inclusion in Labour’s manifesto.

Chief Secretary to the Treasury Darren Jones told Parliament that “no government minister of any political party should have, nor ever should behave in this way,” and suggested Mandelson may have misrepresented his interests before taking up his ambassadorial role. “When someone lies in their declaration of interests, there must be a consequence,” Jones said.

There is no modern precedent for removing an individual from the House of Lords, a step that would require primary legislation. The last such action occurred during the First World War, when a group of peers aligned with Britain’s enemies were stripped of their titles.

No timetable has been set for the Cabinet Office review, and Downing Street has not confirmed whether its findings will be made public. The inquiry may involve examining archived government documents and interviewing Mandelson and other senior officials who served in Downing Street during the period in question.

Tyler Durden Tue, 02/03/2026 - 10:23Coast Guard: Actions Needed to Address Challenges that Hinder Maritime Security Operations

Pepsi Cuts Some Prices As Much As 15% As K-Shaped Economy Squeezes Consumers

Readers already know the K-shaped economy is not going anywhere, even as the Trump administration attempts to correct the imbalance ahead of the midterms. For the junk-food-hungry U.S. consumer, there was a small win on Tuesday morning.

PepsiCo announced it will cut prices by 15% on snack brands like Lay's and Doritos to restore affordability and help revive sales.

"PepsiCo is taking a meaningful step to lower the price on many of our most loved snacks by up to nearly 15%. This includes iconic favorites like Lay's, Doritos, Cheetos, Tostitos and more," PepsiCo wrote in a statement.

Rachel Ferdinando, CEO, PepsiCo Foods U.S., said her team has spent the "past year listening closely to consumers, and they've told us they're feeling the strain" from elevated processed food prices.

"Lowering the suggested retail price reflects our commitment to help reduce the pressure where we can. Because people shouldn't have to choose between great taste and staying within their budget," Ferdinando said.

The announcement comes just days before the Super Bowl this weekend, as consumers rush to supermarkets to stock up on junk food for the big game, with this year's main event featuring the Seattle Seahawks against the New England Patriots.

We must note, and can't help but wonder, whether activist investor Elliott Investment Management, which built a $4 billion position in the stock and aimed to overhaul PepsiCo toward greater affordability in late 2025, had any say in the latest decision to trim prices ahead of the Super Bowl.

Pepsi shares were marginally higher in premarket trading in New York. Shares remain -20% from their peak, when they nearly topped $200 per share in mid-2023.

Bloomberg noted that PepsiCo has accelerated its cost-reduction efforts, including reducing headcount, closing three plants, and consolidating several manufacturing lines, with "additional actions planned for the near future." It also announced a product portfolio that would be slashed by 20% in the coming months.

It really does seem like Paul Singer's team at Elliott is busy at work with PepsiCo...

Tyler Durden Tue, 02/03/2026 - 10:00

Recent comments