Futures, Bitcoin, Gold All Tumble As Momentum Liquidations Accelerate

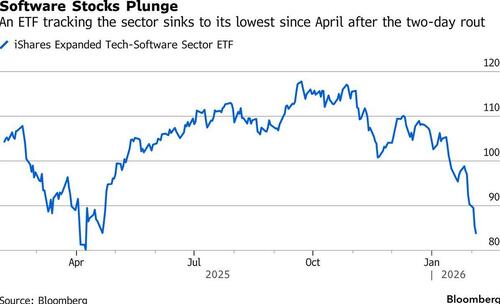

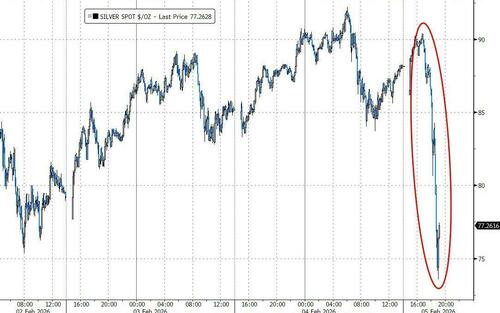

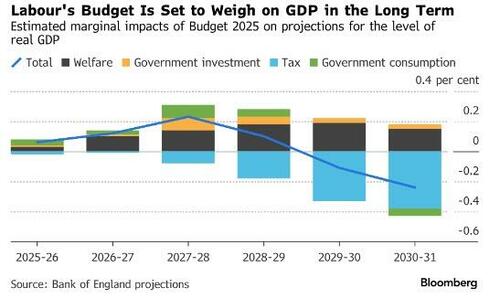

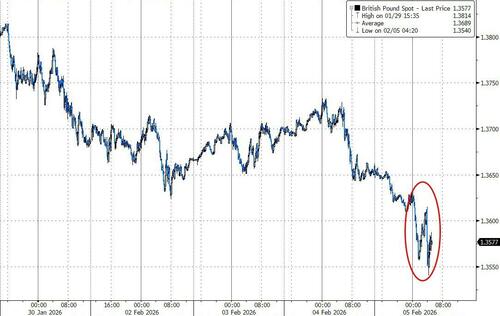

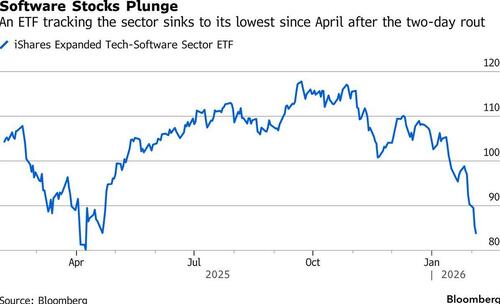

Stock futures slide, hitting session lows just after 7am ET, after a two-day drop that saw an ETF tracking software stocks sink to its lowest since April. As of 8:00am ET, S&P 500 futures have slumped to session lows, down 0.7% following a sharp slide just after 7am ET; Nasdaq 100 futures are also sharply lower, dropping 0.8% after the index wiped out its gains for the year over the prior two sessions. Alphabet is lower in after it said capex will reach as much as $185 billion this year, double what it was in 2025 and far more than the $120 billion analysts had predicted. Pre-market, Mag7 are all lower but GOOG’s capex guidance is boosting some semis who will benefit from the extra spending. This morning, the tech selloff was joined by a resumption in the precious metal liquidation as silver plunged -15% during China hours, and gold slid 3% following yesterday’s Momentum unwind (which continues today). The USD reversed all gains and traded near session lows as 10Y yields also dropped to session lows just over 4.25%. Today’s macro focus is on the jobs including claims and Challenger job cuts. We get Amazon earnings after the close.

In premarket trading, Mag 7 stocks are all lower: Alphabet (GOOGL) falls 4% after the Google parent forecast full year 2026 capital expenditures of up to $185 billion, far exceeding consensus estimates. Analysts said the jump in spending may concern some investors, while others said it underscored the company’s confidence with AI (Nvidia drops 0.1% alongside AI infrastructure peers; Tesla -1%, Amazon -1%, Meta -1%, Apple -0.2%, Microsoft -1.8%)

- Align Technology (ALGN) climbs 11% after the medical devices firm reported adjusted earnings per share for the fourth quarter that surpassed Wall Street’s estimates.

- ARM Holdings (ARM) falls 7% after the company’s sales forecast disappointed investors, who are concerned about a slowdown in the smartphone market.

- Carrier Global (CARR) falls 6% after the HVAC company forecast full-year sales below what analysts expected. The company said it expects market conditions from the second half of 2025 to continue this year in its Americas residential business, which has struggled with weak demand.

- Elf Beauty (ELF) jumps 4% after the cosmetics company boosted its adjusted Ebitda guidance for the full year, beating the average analyst estimate. Analysts highlight strong performance in its newly-acquired Rhode, Hailey Bieber’s beauty and skincare brand.

- Estée Lauder Cos. (EL) tumbles 12% after its outlook boost failed to reassure some investors about the pace of the cosmetics conglomerate’s turnaround.

- Fluence Energy (FLNC) drops 17% after the energy storage technology company’s fiscal first quarter revenue fell shy of analyst estimates.

- Hershey Co. (HSY) rises 3% after offering a better-than-expected 2026 outlook as higher prices and new products bolster the candymaker’s performance.

- KKR & Co. (KKR) slips 2% after agreeing to acquire sports and secondaries investor Arctos Partners in a $1.4 billion deal, in a major push into a booming industry.

- Qualcomm (QCOM) falls 11% after the chipmaker’s revenue forecast was weaker than expected. The company said its “near-term handsets outlook is impacted by industry-wide memory supply constraints.”

- Symbotic (SYM) is up 5% after the technology firm forecast total revenue for the second quarter that topped the average analyst estimate.

In other company news, HSBC is said to be preparing to hand some bankers little or zero bonuses in a move to get some underperforming staff to depart. Shell profits slumped in the fourth quarter, hit by lower crude prices and a weak oil-trading performance.

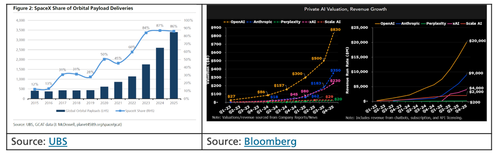

Traders are weighing whether the flight from tech has been excessive, driven by concerns over disruption from artificial intelligence, lofty valuations and vast capital outlays. Sectors that stand to gain from faster economic growth have been the main beneficiaries of the shift. As for the biggest losers, the answer is easy: software, which the market has convinced itself will not exist thanks to AI agents.

“Three quarters of software stocks are in oversold territory, and the momentum trade that has been the way to play tech and software last year is under severe pressure,” said Andrea Gabellone, head of global equities at KBC Securities. “I expect reason to come back to the table and a rebound shortly,

AI remains top of mind, with one Wedbush trader saying that “Alphabet’s mic drop capex highlights haves versus have nots in AI capabilities, commitment and balance sheet.” There are only a few companies that have the ability to spend more on AI and see ROI across their entire ecosystem, said Joel Kulina, managing director for TMT trading at Wedbush Securities. Alphabet, Meta and Anthropic are on his list.

The impacts of AI are rippling elsewhere. Shares of Qualcomm and Arm are sharply lower on concerns that a shortage of memory chips will limit phone production. Traders are looking for the floor for AI losers, with Jefferies’ trading desk predicting the group is due for a “vicious rally” but Morgan Stanley's Quants warning that the selling is just starting.

Futures for the Russell 2000 small cap index continued to outperform those for the S&P 500. In another sign that appetite for diversification remained strong, the rolling four-week average inflows into consumer staple stocks have reached a record, according to Bank of America analysts. These inflows hit the highest level on an absolute basis and by percentage of market capitalization since the bank started tracking client fund flow data in 2008, Jill Carey Hall, an equity and quant strategist, said in a Wednesday note.

“We don’t see it as a big plummet in tech stocks, we see it more as the rest catching up in terms of earnings,” Shanti Kelemen, co-chief investment officer at 7IM, told Bloomberg TV.

Overall positioning in equities remains elevated, despite a broad unwind in crowded trades, leaving stocks vulnerable to downside moves in the near term, according to JPMorgan’s cross-asset indicator. Positioning changes across many assets were largely modest this past week with the exception of a severe reduction in long positions in silver. And speaking of silver, a sudden 17% plunge wiped out a two day recovery, as the commodity struggled to find a floor following a historic rout. Gold traded near $4,900 an ounce. Bitcoin slumped below $70,000, a level last seen in 2024 amid wider cross-asset stress.

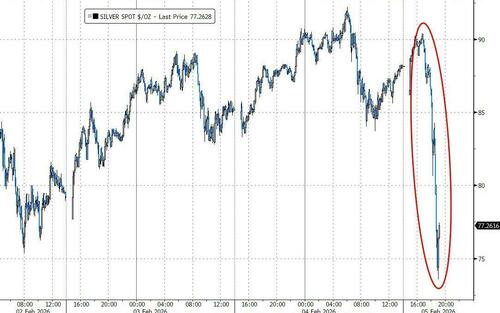

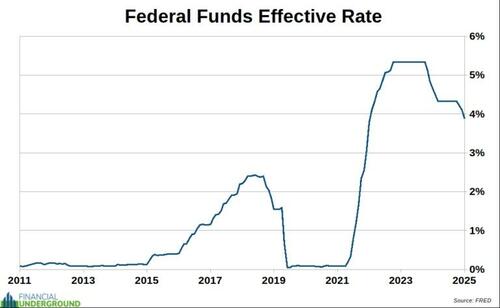

This morning, the Bank of England came within a vote of cutting interest rates as policymakers split 5-4 in favor of holding at 3.75%. The pound extended losses after the decision, having been under pressure as a fresh round of political turbulence weighed on UK assets. Shorter-end gilts jumped as traders ramped up bets on a rate cut in March, sending two-year yields eight basis points lower to 3.62%.

In geopolitics, China is asking state firms to halt talks over new projects in Panama. The Trump administration hosted a critical minerals summit with 55 countries to reduce dependence on China, with the US pitching price floors and US private equity investment.

Out of the 254 S&P 500 companies that have reported so far in the earnings season, 79% have managed to beat analyst forecasts, while 17% have missed. ConocoPhillips, Bristol-Myers Squibb and KKR are among companies expected to report before the market open. ConocoPhillips heads into 4Q against a softer crude backdrop, with trimmed volumes and leaner capital spending. Earnings from Amazon and Microchip follow later in the day: as usual, AI spending plans will be the main focus.

Europe's Stoxx 600 fell 0.4% to 615.69. Trading in Europe signaled that the rotation away from tech into economically sensitive stocks was slowing. The Stoxx 600 headed for its worst day in more than two weeks as the auto sector led losses, while chemical and retails stocks also underperformed. Here are some of the biggest movers on Thursday:

- BNP Paribas shares rise as much as 4.7% after the French lender reported net income for the fourth quarter that beat the average analyst estimate and raised some targets, with KBW analyst saying earnings are solid and JPMorgan noting that new targets imply upside.

- Pandora rises as much as 8.2%, driven by a plunge in the spot silver price and after reporting its full-year 2025 results.

- Rational shares rise as much as 16% after the German manufacturer of catering appliances impressed analysts with its fourth quarter profits and cost discipline.

- Danske Bank shares rise as much as 4.5% to a record high as the Danish lender’s quarterly profits and revenues beat expectations.

- Rheinmetall shares fall as much as 9.5% after the German maker of tanks and ammunition hosted a pre-close call with analysts which implied downgrades to consensus numbers for 2026.

- Siemens Healthineers shares drop as much as 2.7% after the German medical equipment maker reported sales for the first quarter that missed expectations, hurt by its diagnostics business, while earnings were better than expected.

- Shell slips as much as 2.6% after delivering fourth-quarter earnings below analyst expectations, with Morgan Stanley saying that estimates had already come down ahead of the report.

- Maersk falls as much as 8.2% after the Danish shipping group provided an outlook for 2026 in which it expects earnings to fall as the reopening of the Red Sea shipping route leads to lower rates.

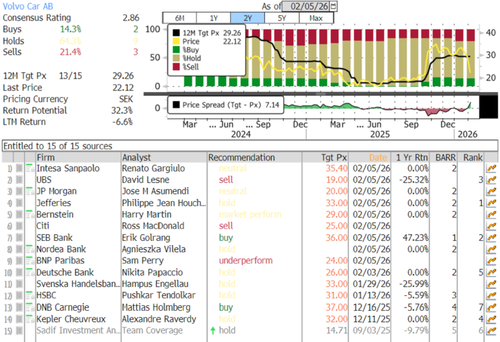

- Volvo Car shares fall as much as 24%, their biggest drop on record, after the automaker reported weaker-than-expected fourth quarter earnings, dragged down by poor demand and pressure on prices.

- Saab shares fall as much as 4.6% after full-year results as Morgan Stanley says a midterm guidance raise only implies limited upgrades to consensus.

- Vestas shares fall as much as 7% after the Danish wind company forecast revenue for 2026 of €20 billion to €22 billion. Analysts at RBC Capital and JPMorgan blame a weaker services segment for dragging revenue.

In fx, the dollar rose 0.2%, hitting the highest level in two weeks amid the selloff in precious metals. The pound tumbled after the Bank of England came within a vote of cutting interest rates as policymakers split 5-4 in favor of holding at 3.75%; the currency was under pressure as a fresh round of political turbulence weighed on UK assets. Shorter-end gilts jumped as traders ramped up bets on a rate cut in March, sending two-year yields eight basis points lower to 3.62%.

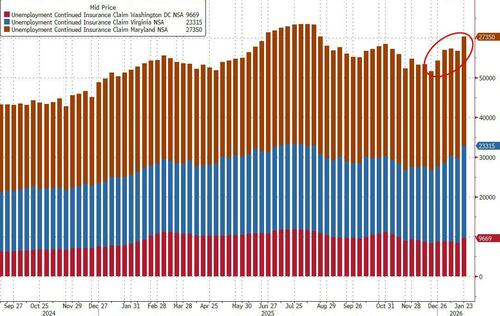

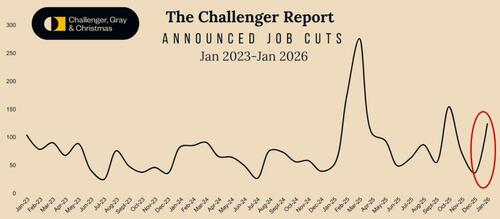

In rates, treasury yields fell as US companies announced the largest number of job cuts for any January since 2009, according to data from Challenger, Gray & Christmas Inc. The 10-year rate slipped two basis points to 4.52%. The European Central Bank is expected to stand pat on rates later on Thursday. The euro was little changed.

In commodities, oil prices decline for the first time in three days after Iran confirmed it would hold negotiations with the US, easing tensions in the region. Spot silver is down over 10% while Bitcoin falls almost 4% below $70,000.

Challenger job cuts for January are due at 7:30 a.m. ET, followed by JOLTS job data for December at 10 a.m. Fed’s Bostic is scheduled to speak at an event at 10:50 a.m.

Market Snapshot

- S&P 500 -0.4%

- Nasdaq 100 mini -0.6%

- Russell 2000 mini -0.5%

- Stoxx Europe 600 -0.6%

- DAX -0.5%

- CAC 40 little changed

- 10-year Treasury yield -1 basis point at 4.27%

- VIX +0.9 points at 19.54

- Bloomberg Dollar Index +0.2% at 1194.43

- euro -0.2% at $1.1783

- WTI crude -1.5% at $64.19/barrel

Top Overnight News

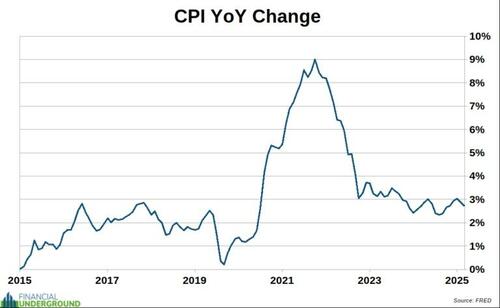

- Warsh believes that the AI boom is the “most productivity enhancing wave of our lifetimes – past, present and future,” leaving the Fed space to cut rates without stoking inflation. FT

- Republican Senator Hawley is circulating a bill around Congress that would ensure the costs of data centre's energy use is not passed onto consumers: Axios

- President Trump commented that Fed is in theory an independent body, adds looking at tariff rebate checks very seriously, but hasn't committed to tariff rebate checks yet, while he discussed expanding immigration operations to five cities.

- December’s delayed JOLTS report is expected to show a modest rebound in job openings after recent declines, but slow hiring, cautious worker churn and weak quits suggest the labor market remains subdued. BBG

- Most Chinese provinces are targeting lower economic growth this year, in what many economists believe is a signal Beijing will set a historically low range of 4.5-5% for its official goal in 2026. FT

- A landslide win for Japan's ruling Liberal Democratic Party (LDP) at Sunday's election may be the best outcome for bonds and the yen, even as Takaichi's spending pledges have repeatedly rocked markets. Analysts say an overwhelming LDP victory may in the end be positive for bonds, as it would eliminate the need for Takaichi to negotiate with opposition parties, who are touting even deeper tax cuts and broader fiscal spending. RTRS

- Japan’s 30-year bonds gained after an auction of that tenor drew stronger demand, easing immediate concerns about longer-maturity debt just days from a closely watched election. The yield on 30-year bonds fell as much as seven basis points to 3.565% after the bid-to-cover ratio at the Ministry of Finance’s sale rose from last month’s auction. BBG

- German factory orders unexpectedly rose at the fastest pace in two years, supporting expectations of a recovery in the key manufacturing sector. Factory orders for December come in very strong at +7.8% M/M (vs. the Street -2.2%). FT

- UK political turmoil weighed on sterling and gilts as fresh doubts emerged over PM Keir Starmer’s grip on power. The gap between two-year and 10-year gilt yields steepened to the widest since 2018, while sterling was the worst-performing currency among peers. BBG

- Lisa Cook said the Fed must maintain its credibility by returning inflation to target in the near future. BBG

- Volodymyr Zelenskiy called on Trump to send more weapons for his military, according to an interview with France 2. Kyiv also said meetings between Ukraine, the US and Russia in Abu Dhabi were “meaningful and productive.” BBG

Trade/Tariffs

- India's Foreign Ministry said they are looking to explore commercial merits of any crude supply, including from Venezuela.

- India's Trade Ministry Officials said that India will need to import USD 300bln annual worth of goods and the US will be one of the key suppliers of energy, aircraft and chips.

- Indian Trade Minister said we will announce the first tranche of a trade deal agreed with the US.

- China's Foreign Ministry said we oppose any country forming small groups to disrupt international economic and trade order.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly lower following the continued tech selling stateside and flip-flopping regarding US-Iran talks, while commodities were pressured overnight with silver prices dropping by a double-digit percentage. ASX 200 was dragged lower by weakness in mining and resources stocks after underlying commodities prices took a hit, but with the losses in the index stemmed by resilience in financials and consumer stocks. Nikkei 225 saw early indecision but eventually slipped below the 54,000 level alongside the downbeat mood in the region. Hang Seng and Shanghai Comp declined with notable weakness in miners, property names and insurers, while an increased liquidity effort by the PBoC and reports of an 'excellent' call between Trump and Xi failed to spur risk appetite.

Top Asian News

- Chinese provinces set lower growth targets for 2026, according to FT.

- China is said to pause Panama deals after CK Hutchinson's (1 HK) port operations were nullified.

European equities (STOXX 600 -0.6%) are broadly lower, though the AEX is mildly firmer, boosted by strength in ASML (+1.1%). The chip giant has been boosted after Google noted it would boost AI spending. European sectors hold a negative bias. Basic Resources underperforms given the pressure in the metals complex, whilst Shell (-2%, Q4 metrics light) weighs on the Energy sector. Other key movers include Volvo Car (-22%) after poor results and a dire outlook.

Top European News

- Maersk (MAERSKB DC) Q4 (USD) EBITDA 1.8bln (exp. 1.84bln), Revenue 13.3bln (exp. 12.9bln).

- Shell (SHEL LN) Q4 (USD): Adj. Profit 3.26bln (exp. 3.51bln), EPS 0.57 (exp. 0.63), Adj. EBITDA 12.79bln (prev. 14.77bln Y/Y), announces USD 3.5bln share buyback programme.

FX

- DXY is kept afloat as it continues to claw back losses seen towards the end of January. That being said, the upside is limited following mixed data releases stateside and with plenty of focus on geopolitics amid reports that US-Iran talks scheduled for Friday were off, and on again. DXY has topped resistance seen around the 97.70-97.75 area to reach a current high of 97.83, still some way off the 23rd Jan high at 98.481.

- GBP/USD is among the laggards heading into the BoE, but likely more on political factors at the moment, with UK PM Starmer's premiership coming under scrutiny for his decision to appoint Peter Mandelson as the US ambassador despite links to Epstein. Back to the BoE, the Bank Rate is expected to be maintained at 3.75%, with some mixed views on the vote split. GBP/USD resides towards the bottom end of a 1.3576-1.3664 range.

- EUR/USD resides in a narrow 1.1783-1.1809 range ahead of the ECB announcement and presser. The ECB is expected to keep its rates on hold, a view held by the likes of Goldman Sachs and Morgan Stanley. Data developments play in favour of keeping rates steady; inflation dipped below the Bank’s target in January, but largely due to base effects. Focus this meeting will be on any commentary surrounding the stronger EUR, trade/geopolitical uncertainty and higher gas prices.

- USD/JPY continues rising amid the firmer USD, with the pair back above 157.00, with yen weakness persisting throughout the week ahead of the snap elections on Sunday. Elsewhere, Antipodeans are softer with AUD the G10 laggard amid headwinds from the subdued risk appetite and selling pressure in commodities.

Central Banks

- Fed's Cook (voter) said she will continue to carry out duties at the Fed and she looks forward to getting to know Warsh. said:Hopes that goods inflation will dissipate quickly, and once they do, should be back on the disinflation path.

- Fed's Cook (voter) said she is focused on inflation risks and noted that when considering the proper stance of monetary policy, she sees risks to both sides of the dual mandate. said:. Progress on inflation has stalled, while such a plateau is frustrating after seeing significant disinflation in the preceding few years. It is essential we maintain credibility by returning to a disinflationary path.

- Federal Reserve finalizes big bank stress test criteria, votes to keep current capital buffer; Bowman said freezing bank capital levels allows Fed to correct any "deficiencies" in stress test models.

- Westpac's Ellis said can't rule out the RBA raising interest rates for a second consecutive time in March, according to Bloomberg.

- China Securities Daily reported that analysts now expect PBoC RRR 'cuts' in Q2.

Fixed Income

- USTs are currently firmer by a couple of ticks and trade within a narrow 111-18+ to 111-24 range. Not much driving things for the benchmark this morning, but the focus has been on geopolitics. On Wednesday, it was reported that the US-Iran talks were cancelled, but are now back on and set to happen on Friday. Back to the US, the BLS provided an updated data schedule following the recent partial shutdown. JOLTS is set to be released today; NFP on Feb 11 and CPI on Feb 13. That aside, Jobless Claims is due today, with traders looking to see if the labour market remains in its recent “low hiring – low firing” environment.

- Bunds trade steady and in a narrow 127.88-128.07 range. Really not much driving things for the benchmark this morning aside from EZ Construction PMIs and Retail sales, which had a limited impact on price action. Ahead, the ECB is set to keep its deposit rate at 2.00% and is likely to reiterate that the Bank is in a good place. Focus will be on the recent strength of the EUR and any comments related to potentially undershooting inflation.

- Gilts are underperforming this morning, currently lower by around 40 ticks. Initially gapped lower by around 19 ticks, and then extended lower to make a trough of 90.13. The underperformance in Gilts today can be attributed to the increased pressure that PM Starmer is facing for his decision to appoint Peter Mandelson as the US ambassador, despite knowing about his links to Epstein. As it stands, several MPs are calling for Starmer to resign whilst others are calling for the sacking of Chief of Staff McSweeney; MP Turner said if he does not sack him, then his own back will be “up against the wall… soon” – nonetheless, the did suggest that there is still support for the PM adding that MPs do not want him to go. As it stands, Polymarket odds of Starmer to be out the door by June 30th have risen to 47% (vs 23% yesterday).

Commodities

- Crude benchmarks continued to trade with a lack of clear direction. The pressure seen at the start of the week (following plans of US-Iran talks) was completely reversed in Wednesday's session over reports that the talks have been cancelled due to Tehran's demands to change the location and talk format. Late in Wednesday's session, Iran's Foreign Minister reconfirmed that talks are back on in Oman for Friday. Prices dropped at the end of the US session. As the European session got underway, benchmarks reversed overnight losses, with Brent returning above USD 68.50/bbl. Today is the expiration day of the New START Treaty. This outcome was expected amid a lack of effort from both sides to renew the agreement.

- Spot gold ended Wednesday's session below the USD 5,000/oz handle but attempted to regain above the level at the start of the APAC session, but failed to do so. The yellow metal fell to a low of USD 4,790/oz, weighed on by the plunge in silver prices, before slightly paring back losses as European trade gets underway.

- Spot silver wiped out the entirety of the two-day recovery the metal attempted to stage as trade at the Shanghai Metals Exchange got underway. The metal kissed USD 90/oz before slipping to a trough of USD 73.55/oz, with losses seen as much as 16%. Dip-buyers took advantage of the lower prices, with silver prices currently trading around USD 80/oz.

- China gold consumption reportedly fell by 3.6% to 950 tons in 2025 and total gold production rose 3.35% Y/Y to 552 tons.

- 3M LME Copper continued the selloff seen throughout the US session, with the red metal dipping below USD 13k/t to a trough of USD 12.86k/t. This comes following continued worries that AI will become a bigger factor within business models. The tech sector has been weighed on in recent sessions, as in turn, dragged copper prices lower

Geopolitics: Ukraine

- US Envoy Witkoff said that discussion between US, Ukraine and Russia were productive but "significant work remains"; talks will continue, with additional progress anticipated in the coming weeks; Ukraine and Russia agreed to exchange 314 prisoners.

- Russia's Kremlin spokesperson confirms the New START Treaty ends today.

- Russian Envoy Dmitriev said Russia-US meetings in Abu Dhabi are positive; progress on a peace deal despite pressure from the EU and UK; active work ongoing to restore Russia-US relations.

Geopolitics: Middle East

- Israeli security assessments note Houthis may attack Israel if Washington launches a strike against Iran, according to Sky News Arabia.

- Palestinian media reported Israeli artillery shelling targeting the Al-Bureij camp in the central Gaza Strip.

US Event Calendar

- 8:30 am: United States Jan 31 Initial Jobless Claims, est. 212k, prior 209k

- 8:30 am: United States Jan 24 Continuing Claims, est. 1850k, prior 1827k

- 10:00 am: United States Dec JOLTS Job Openings, est. 7250k, prior 7146k

- 10:50 am: United States Fed’s Bostic Speaks with Dean of Clark Atlanta University

DB's Jim Reid concludes the overnight wrap

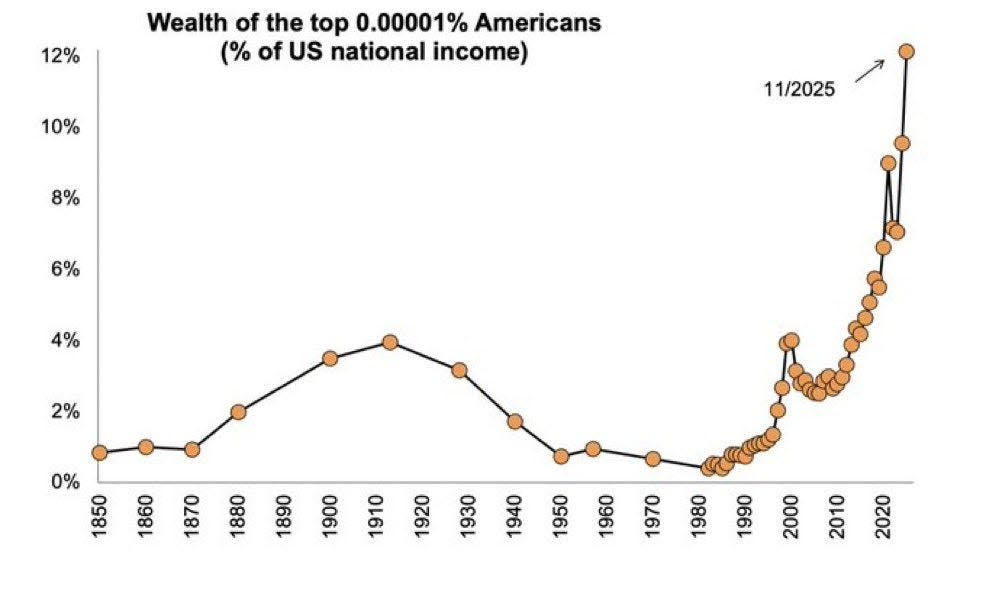

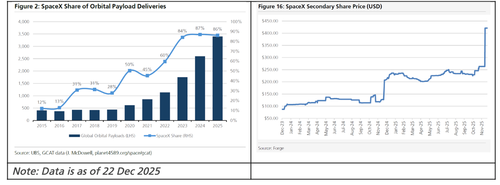

Morning from Paris as the global tour continues. There's plenty to talk about as 2026 continues to develop in a fascinating way and Tuesday’s software sell-off broadened into a wider tech rout yesterday, as concerns about AI disruption pushed the NASDAQ (-1.51%) and the Mag 7 (-1.75%) to further declines, which in turn meant the S&P 500 (-0.51%) fell back for a second day running. However, it wasn’t all bad news, as the ongoing rotation out of tech meant the equal-weighted S&P 500 (+0.88%) closed at a record high, as did Europe’s STOXX 600 (+0.03%). So there’s a pretty divergent narrative at the minute, whereby tech stocks are being squeezed sharply, but a lot of broader indices are still holding up for the most part. If that's not enough excitement for you, Silver has fallen -14% overnight and Alphabet has stunned the world with a capex spending plan of as much as $185bn this year, 55% more than expected. With tech in a current state of flux it's not clear whether that's a good or a bad thing. Alphabet has been the brightest star in the tech space in the last 6 months so this is a big story for markets.

I explored the tech story in my chart of the day yesterday (link here), looking at various stocks and how far they were beneath their 52-week high. It shows how recent months have seen a shift from the “every tech stock is a winner” mindset to a more brutal landscape of winners and losers. There are lots of losers but note that Alphabet has added $1.7tn market cap over the last 6 months (adding over 70% of its value), offsetting a lot of other losses and helping the S&P 500 to still be only -1.37% beneath its all-time high.

Last night Alphabet's results delivered a solid revenue beat, with Google Cloud revenue growing 48% to $17.7bn in Q4 (vs $16.2bn expected). However, this was accompanied by a surge in the company’s CAPEX plan to $175-185bn in 2026, effectively doubling its 2025 spend and well above the average analyst estimate of $120bn. Alphabet’s shares saw some sizeable volatility in after-hours trading (falling -7% at one point) but were little changed in the end after falling by -1.96% in the regular session. This morning, S&P 500 (+0.03%) and NASDAQ 100 (+0.14%) futures have been fluctuating between gains and losses.

Yesterday’s sell-off was led by a fall in AMD (-17.31%), which was the second-worst performer in the S&P 500 after the company’s latest outlook disappointed investors. So that marked its worst daily performance since 2017. That weighed on chipmakers, with the Philadelphia Semiconductor index down -4.36% including a -3.41% retreat for Nvidia, and the news fed into the wider narrative of tech weakness in recent days. Moreover, we saw the impact in other asset classes too, as Bitcoin (-4.61%) fell back to its lowest level since November 2024, at $72,627.

Despite the headline losses, there were an impressive 363 advancers in the S&P 500, which was actually the most in two weeks. Energy stocks (+2.25%) led the gains as Brent crude rose +3.16% amid renewed concern over US-Iran escalation. Oil spiked after Axios reported that plans for nuclear talks with Iran were at risk of collapse and as President Trump said that Iran's supreme leader Ayatollah Khamenei “should be very worried", though it pared back some of the rise on news that Friday’s talks were still set to go ahead with Brent down -2.16% to $67.96/bbl overnight as I type.

Prior to that, other newsflow yesterday leant on the more positive side for markets, including the news that Presidents Trump and Xi had another telephone conversation. According to a post from President Trump, they discussed various topics, and he said China had committed to purchasing 25mn tonnes of soybeans for next season. So that meant soybean futures (+2.49%) posted their biggest jump since November, and it added to hopes that the trade truce between the two sides would remain in place.

Meanwhile, the US data yesterday continued to paint a broadly positive picture. The ISM services print came in at 53.8 (vs. 53.5 expected), which is its highest level since late-2024. However, some of the details were a bit more mixed, as the subcomponents for new orders (53.1 vs 56.5 expected) and employment (50.3 vs 51.7 expected) missed expectations. Moreover, the prices paid component ticked back up to 66.6 (vs. 65.0 expected), and that’s been a strong leading indicator for US inflation, which added to concern on that front. Meanwhile, the ADP’s report of private payrolls also came out weaker than expected in January at 22k (vs. 45k expected), with a slight downward revision to prior months. Normally that would be followed by the jobs report tomorrow, but given the partial government shutdown, the BLS confirmed yesterday that it was being postponed to Wednesday next week.

Lastly in the US, we had the Treasury’s quarterly refunding announcement, which came out unchanged in line with expectations. Treasury yields were mixed in response, with the 2yr yield falling -1.6bps amid the risk-off mood but 10yr (+1.0bps to 4.28%) and 30yr (+2.3bps to 4.92%) yields continuing to rise. Indeed, that brought the 2s10s slope up to 71.6bps, its steepest since January 2022, before the Fed started its post-Covid hiking cycle. Overnight, 10yr USTs are -1.0bps lower trading at 4.26% as we go to print.

Over in Europe, attention will be all on central banks today, as both the ECB and BoE are announcing their latest decisions. The ECB is widely expected to keep its deposit rate on hold at 2%, and our European economists think that it’ll continue to emphasise two-sided risks to growth and inflation. However, the risk is that the ECB sounds more dovish than before, given heightened geopolitical uncertainty and the recent appreciation in the euro. You can see their full preview here. Meanwhile for the BoE, our UK economist also expects no change in Bank Rate (3.75%), with a 7-2 vote tally to keep policy on hold (see his preview here). Indeed it's worth keeping a closer eye on the UK with PM Starmer under considerable domestic pressure given the handling of the Peter Mandelson story. 10yr Gilts were up +2.9bps yesterday bucking the international trend as concerns grew that he could be replaced. So one to watch.

Asian equity markets are lower this morning with the KOSPI (-3.98%) standing out as the largest underperformer, having surged to record highs in the previous two sessions, with major index constituents Samsung Electronics and SK Hynix both falling by over -5.0%. The index is still up over +22% in 2026 so far. Chinese stocks are also lagging behind, as evidenced by the Hang Seng (-0.68%), the CSI (-0.52%), and the Shanghai Composite (-0.59%), all of which are trading significantly lower. In other markets, the Nikkei (-0.85%) is also trading lower, retreating from the record highs it reached earlier this week.

Ahead of today’s ECB decision, yesterday we received the Euro Area flash CPI print for January, with headline inflation in line with expectations at +1.7%, marking its lowest level since 2021. Core CPI was still higher at +2.2%, but a bit below expectations for a +2.3% print. So that added to expectations the ECB might still cut this year, and yields on 10yr bunds (-3.1bps), OATs (-1.9bps) and BTPs (-2.9bps) all moved lower. Moreover, the 30yr German yield also fell -2.5bps to 3.52%, down from its post-2011 high the previous day. Meanwhile for equities, things were modestly positive, with record highs for the STOXX 600 (+0.03%) and the FTSE 100 (+0.85%), although the German DAX (-0.72%) struggled amidst a sharp fall in industrial stocks.

Looking at the day ahead, in addition to the ECB and BoE decisions, we’ll hear the Fed’s Bostic speak, BoC Governor Macklem speak, and get the BoE’s DMP survey. In terms of data, we’ll get the US initial jobless claims, UK January new car registrations, construction PMI, Germany December factory orders, January construction PMI, France December industrial production, Italy December retail sales, Eurozone December retail sales. Finally, earnings include Amazon, Shell, BBVA and Sony.

Tyler Durden

Thu, 02/05/2026 - 08:15

via Chinese state media/BBC

via Chinese state media/BBC

Recent comments