Futures Rebound To Session High As Software, Gold And Bitcoin All Jump

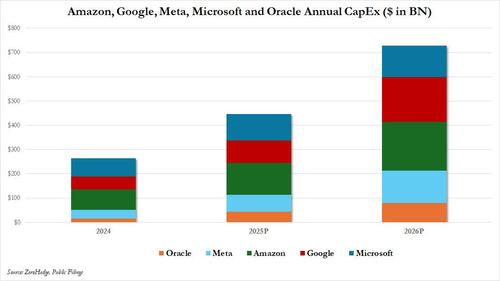

US equity futures are poised to open higher with Software companies finally bouncing (as previewed here), even though Amazon continues to be deep in the red after its eye-watering capex outlook. US stocks will cap a bruising week in which a rush to unwind crowded trades - from AI shares to precious metals and crypto - triggered margin calls and amplified the market’s slide. With the S&P 500 on track for its worst week this year, S&P futures are 0.6% higher at 8:15a.m. ET while contracts on the Nasdaq 100, which just suffered its ugliest three days since Trump’s trade war sent markets into a tailspin in April, were up 0.8% after erasing an earlier decline while precious metals and cryptocurrencies climb after falling sharply on Thursday. In premarket trading, Mag 7 are mostly higher except for AMZN which is down -7% post-earnings on a staggering capex guidance ($200BN, vs $146BN est); NVDA +2.7%, MSFT +1.6%. Yields are 1-3bp higher led by the front-end overnight while the USD is at session lows. Commodities are mixed: base metals are lagging, while gold and silver added 2.0% and 4.4%, respectively; oil added 0.4% overnight. Oil trades near session lows as US-Iran nuclear talks take place. Bitcoin has bounced more than 10% from its session lows just above $60K as dip buying makes a tentative comeback.

In premarket trading, Mag 7 stocks are mostly higher with one exception: Amazon is down 7% after the company announced plans to spend $200 billion this year on data centers, chips and other equipment, worrying investors that its colossal bet on artificial intelligence may not pay off in the long run. AI infrastructure stocks rally after Amazon’s massive capex forecast. Gainers include AMD (AMD) +2%. Other Magnificent Seven stocks: Tesla +0.6%, Alphabet -1%, Microsoft +1.3%, Apple -0.4%, Meta Platforms +0.08%

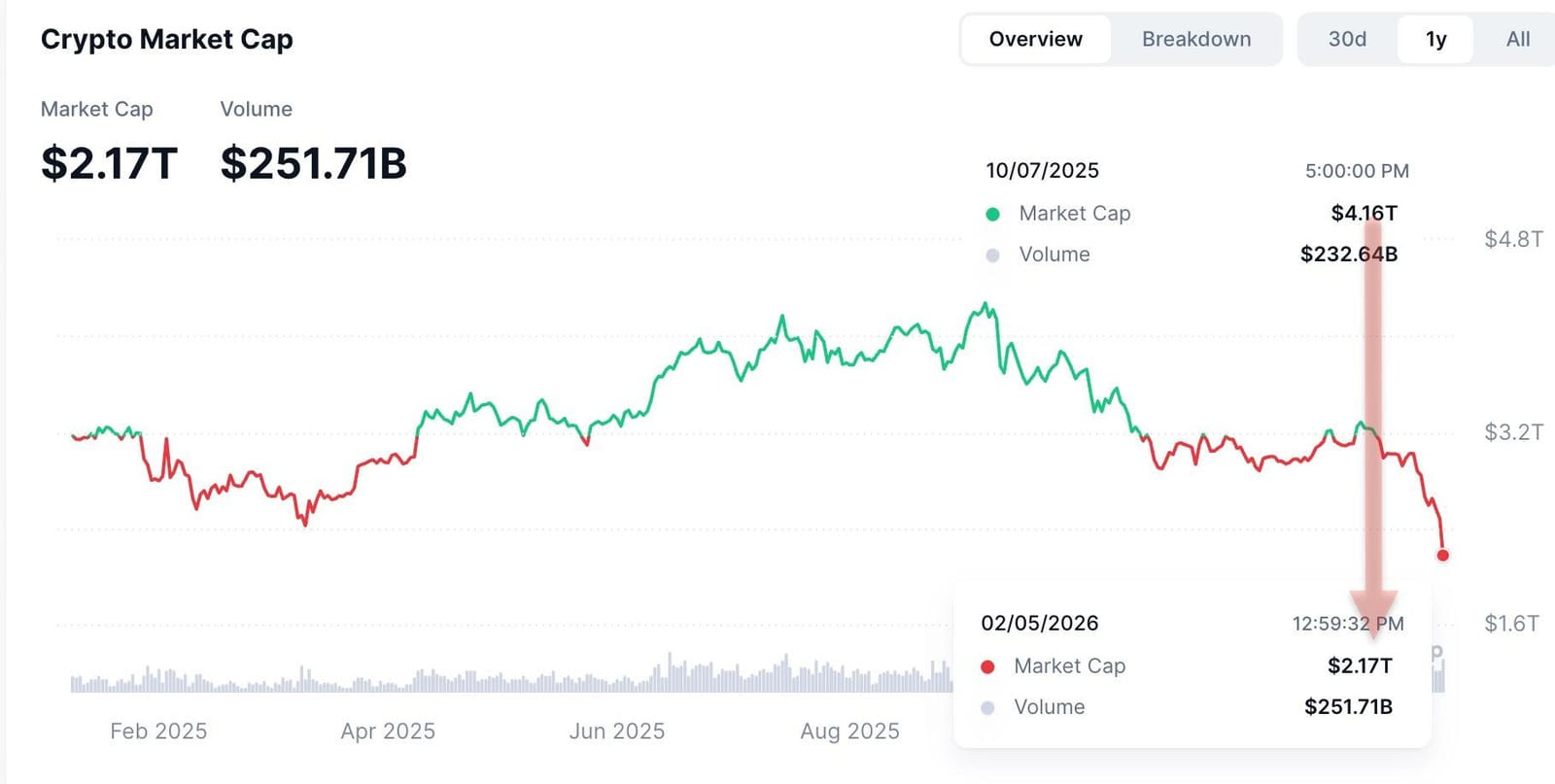

- Cryptocurrency-linked stocks rally as Bitcoin rebounded after a selloff that briefly dragged the token to a more than 50% retreat from its October peak.

- Bill Holdings (BILL) rises 12% after the payments-automation company raised its full-year forecast.

- Bloom Energy (BE) rises 13% after the manufacturer of solid-oxide fuel cells gave a forecast for 2026 revenue that beat the average analyst estimate.

- Hims & Hers Health (HIMS) falls 8% after FDA Commissioner Marty Makary said his agency will take “swift action against companies mass-marketing illegal copycat drugs, claiming they are similar to FDA-approved products.”

- Impinj (PI) falls 27% after the semiconductor device company gave an outlook that is much weaker than expected, given an inventory overbuild. The results prompted a downgrade

- Molina (MOH) tumbles 25% after the health insurer forecast 2026 profit that was less than half of Wall Street’s expectations.

- Reddit (RDDT) climbs 8% after the social-media company’s fourth-quarter results beat expectations across key metrics. It also gave an outlook that is seen as strong.

- Roblox (RBLX) jumps 8% after the video-game company reported fourth-quarter results that beat expectations on key metrics. It also gave an outlook that is seen as positive.

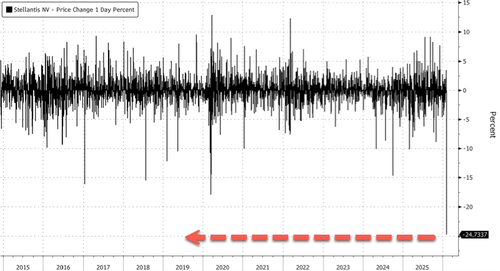

- Stellantis (STLA) plunges 27% after the carmaker said a business reset resulted in charges of around €22.2 billion for the second half of 2025. Akros says the charges were about double what they expected.

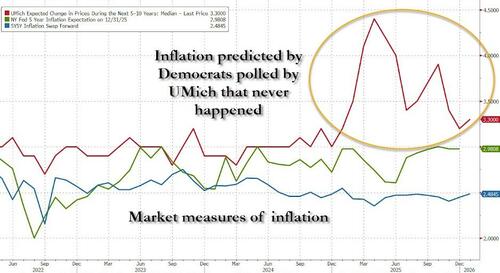

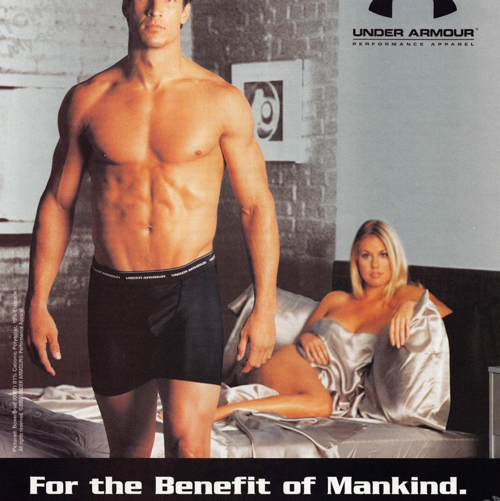

Investors have been spooked by developments on two fronts: the rollout of models from AI startup Anthropic that threaten to render large swaths of software services redundant, alongside the eye-watering spending plans of tech companies. Four of the biggest tech firms plan to invest around $650 billion this year in data centers and the equipment required to run them.

Amazon, almost 8% lower in pre-market trading, is the latest Mag7 member to spook investors about ballooning AI spending, projecting $200 billion for capex this year, far more than the $146 billion Wall Street had penciled in. Taken together with plans from Meta, Google and Microsoft, capital spending by the Big Four AI “hyperscalers” is set to hit about $650 billion this year — up from $356 billion in 2025 and under $100 billion in 2020. On current trajectories, that suggests the quartet’s capex could top $1 trillion in 2027, a scale of investment that’s giving investors pause in what has long been a disinflationary tech industry.

Some investors still appear willing to open their wallets. Oracle’s record-setting bond deal on Monday is an encouraging signal for other big tech firms seeking to raise hundreds of billions of dollars for data-center infrastructure, according to Goldman Sachs’ syndicate desk. Yet if the mounting cost of building AI is rattling markets, so too is the disruption the technology threatens to unleash on other industries. Anthropic is rolling out a new model, Claude Opus 4.6, tailored for financial research - just days after its move into legal services jolted legacy software providers. Meanwhile, Blackstone-backed Liftoff Mobile postponed its IPO this week as a selloff in tech shares compounded investor concerns about AI’s impact.

Still, the week’s retreat is allowing traders to separate stocks facing genuine risk or overvaluation from those caught up in the broader risk-off rout, as the AI rally of the past three years continues to broaden beyond the largest names.

“This is an opportunity for us as active investors to take the baby that has been thrown out with the bath water, because there’s still names out there that we believe will come out very well,” said Fabiana Fedeli, chief investment officer for equities, multi-asset and sustainability at M&G Investments.

For Rory Sandilands, a fixed-income portfolio manager at Aegon Ltd., uncertainty over the disruptive nature of AI may linger as it remains too early to tell how effective the new tools are, or how quickly other software may become obsolete.

“What we’re seeing in the marketplace is fear, because nobody understands really who the winners and losers will be,” Sandilands said. “There’s not enough cushion in credit spreads in aggregate to really to help soften that blow.”

Bitcoin, another canary in the coal mine for risk appetite, touched a new 15-month low of $60,033 on Friday morning, before rallying more than 10%. The original cryptocurrency suffered its biggest daily drop since 2022 on Thursday. Bitcoin’s plunge is intensifying the crisis rocking the digital-asset complex. Few companies are more exposed than Strategy, which confirmed in earnings announcement on Thursday a net loss of $12.4 billion for the fourth quarter, driven by the mark-to-market decline in its vast holdings. Retail investors who piled into the Trump administration’s promised crypto paradise via Wall Street-approved funds are also learning an expensive lesson in market gravity. Crypto funds had their biggest outflows since November in the week ended Feb. 4, Bank of America says, citing EPFR Global data. Money market funds attracted the most inflows, along with stocks. That said, today crypto may finally be due for a rebound: tracking the Software basket, bitcoin is more than 10% above the overnight lows of $60K, trading near session highs of $67K.

Silver has managed a modest rally from Thursday’s 17% leg lower, but remains nearly 39% down from its peak barely a week ago.

Also recall: it may be the first Friday of the month, but there are no non-farms payrolls. Earlier this week, the Bureau of Labor Statistics said the January jobs report would be delayed to next Wednesday because of the partial government shutdown.

Turning to earnings, companies representing nearly 70% of the S&P 500’s market value have now reported in this earnings season. Of the 289 S&P 500 companies to have reported so far, more than 78% have beaten analysts’ forecasts, while 17% have missed. Next week, the calendar is much lighter, with another 8% of the S&P’s market cap reporting. Philip Morris International and Biogen are among those companies expected to report results before the market opens on Friday. PMI investors will be looking for continued strength in its smoke-free portfolio, which includes heated tobacco products and nicotine pouches, to support high-single digit sales growth in the fourth-quarter. For Biogen, all eyes will be on the performance of Leqembi, the drugmaker’s treatment for early Alzheimer’s disease.

European stocks also advance, with construction, utility and bank shares leading gains. Autos underperform as Stellantis shares tumble. Consumer products and chemicals also lag, while construction shares outperform, as French group Vinci announced strong 2025 earnings. Here are some of the biggest movers on Friday:

- Bayer rises as much as 3.2% after the German company said its experimental drug — called asundexian — cut the risk of secondary strokes by 26% in a late-stage trial.

- Kongsberg shares soar as much as 17% after the Norwegian defense firm posted results that Morgan Stanley says delivered a strong end to the year, with all divisions recording double-digit growth in the fourth quarter.

- Vontobel shares rise as much as 6.1% after the investment management firm reported a significant trading-driven earnings beat, according to analysts at Citi.

- Renk Group shares rise as much as 10% after BNP Paribas raises its recommendation on the German defense company to outperform from neutral, citing a reassuring message from the CEO over the upcoming earnings report and the outlook for 2026.

- Stellantis shares fall as much as 24%, the steepest drop on record, after the carmaker said a business reset resulted in charges of around €22.2 billion for the second half of 2025. Akros says the charges were about double what they expected.

- SocGen shares dropped as much as 4.1% following a strong rally after the French lender reported what an RBC analyst says are mixed results as Bloomberg Intelligence notes trading revenue missed estimated and fell short of peers.

- Kering shares fall as much as 5.5% after Morgan Stanley trimmed its price target on the French luxury group ahead of next week’s earnings, saying recent channel checks point to a more difficult start to 2026 than anticipated.

- Coloplast shares drop as much as 9.6% after the Danish medical products-maker reported weaker-than-expected sales and earnings for the first quarter, hurt by its Kerecis skin substitutes business.

- Anglo American shares fall as much as 3.1% after BofA analysts cut the miner’s rating to neutral from buy, citing risks to completing its Teck Resources acquisition and uncertainty over the value of non-core businesses.

- European software and IT services stocks are coming under renewed pressure, tracking declines in Asian and US peers, after Anthropic unveiled a new version of its most powerful artificial intelligence model designed to carry out financial research.

Earlier in the session, Asian stocks pared their initial declines on Friday but still headed for a weekly slide, dragged by concerns over artificial intelligence shares and panic selling in precious metals. The MSCI Asia Pacific Index dropped as much as 1.3% before trading little changed in Friday’s session, with South Korea and Taiwan’s tech-sensitive markets overcame declines. Stocks in Hong Kong dropped and mainland China extended its retreat, while Japan’s market rebounded after opening at a loss. On the week, the regional gauge slid as much as 2.5%, set to snap its streak of advances that started in mid-December. Thailand will also be heading to the polls for a general election, with spending plans and measures to support growth among investors’ top priorities. Shares in India were steady after the central bank kept its benchmark interest rate unchanged, signaling an end to its easing cycle.

“Asian markets have fallen this week as volatility in precious metals prompted investors to reassess stretched valuations more broadly,” said Fabien Yip, market analyst at IG International. A spillover from the US tech selloff has added more pressure, although the region’s decline has been more moderate than global peers, she added.

In FX, the Bloomberg Dollar Spot Index is down 0.2% while the Norwegian krone and Australian dollar are the best performing G-10 currency, rising 0.8% each against the greenback. USD/JPY is little changed ahead of the Japanese election on Sunday.

In rates, treasuries edge lower, pushing US 10-year yields up 2 bp to 4.20%. Gilts lead a rally in European government bonds, with UK 10-year yields falling 3 bps to 4.53%. A combination of the Trump administration’s focus on affordability and a weakening employment picture could open the door to further rate cuts, said Mohit Kumar, chief strategist for Europe at Jefferies.

“Our view remains that we could get a scenario where growth is robust and yet employment is weakening due to the impact of AI,” Kumar wrote. “A Warsh-led Fed could end up being more dovish than what the market currently expects.”

Money market funds attracted the most inflows in the week ended Feb. 4 along with stocks, Bank of America Corp. said, citing EPFR Global data. Crypto funds had their biggest outflows since November, while gold funds saw their first weekly outflow since November.

In commodities, WTI crude futures are steady near $63.30 a barrel as traders eyed the outcome of talks between Iran and the US. Spot silver rises over 5% while Bitcoin rallies back above $66,000 after dropping more than 50% from its October peak.

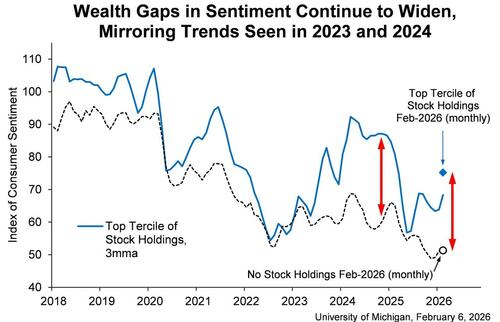

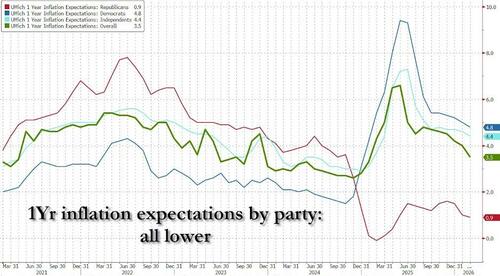

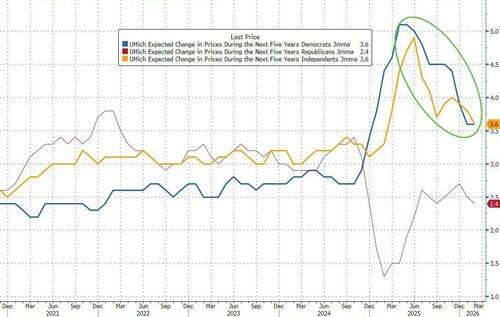

Looking at today's calendar, the University of Michigan’s provisional reading of consumer sentiment in February is due at 10 a.m. ET however.

Market Snapshot

- S&P 500 mini +0.4%

- Nasdaq 100 mini +0.5%

- Russell 2000 mini +0.8%

- Stoxx Europe 600 little changed

- DAX +0.1%

- CAC 40 -0.2%

- 10-year Treasury yield +1 basis point at 4.19%

- VIX -1.3 points at 20.51

- Bloomberg Dollar Index -0.1% at 1193.65

- euro +0.1% at $1.1794

- WTI crude +0.7% at $63.73/barrel

Top Overnight News

- Oil dropped US-Iran talks got underway in Oman, with Tehran indicating that a quick deal is unlikely. BBG

- The U.S. Virtual Embassy in Iran issued a security alert early Friday urging American citizens to “leave Iran now.” The notice came as American and Iranian officials were scheduled for a new round of negotiations in Oman on Friday. CNBC

- Bitcoin is bouncing this morning (currently +525bps), rising after a selloff that briefly dragged the token to more than 50% below its October peak. BBG

- US consumer sentiment probably edged lower at the start of February on concerns about a cooling labor market and elevated prices. BBG

- BOJ board member Kazuyuki Masu highlighted the need for a higher benchmark interest rate. BBG

- Indonesia’s assets slid after Moody’s cut the country’s credit outlook to negative. The cost of insuring sovereign debt rose to around 80 bps, the biggest increase among Asian sovereigns. BBG

- Intel and AMD have notified Chinese customers of supply shortages for server central processing units (CPUs), with Intel warning of delivery lead times of up to six months. The supply constraints have driven up prices for Intel's server products in China by more than 10% generally, although pricing varies by customer contract. RTRS

- Big Tech stocks sold off heavily after the companies unveiled plans to spend $660bn this year on AI, as investors fret that the “breathtaking” capital expenditures are outpacing the eranigns potential of the new technology. Amazon, Google and Microsoft are set to lose a combined $900bn in mkt value since filing their quarterly earnings over the past week. FT

- Sweden’s core inflation slowed more rapidly than expected last month, suggesting a March rate cut may be in play. The CPIF rate excluding energy fell to 1.7% from 2.3% in December. BBG

- South Korean official said US is taking necessary steps regarding the issue of South Korea being on sensitive country lists: Yonhap.

Trade/Tariffs

- Japan and US 1st round of investment to include gas power, ports and artificial diamond, totalling JPY 6-7tln, Nikkei reported.

- Chinese Commerce Ministry said they will lead policy measures to promote travel service exports and boost inbound consumption.

- French President Macron to visit Japan at the end of March, via Nikkei.

- South Africa Trade Minister said they signed a framework economic partnership with China, while the agreement will be followed by an early harvest agreement by end of March 2026, which will then see China provide duty-free access to South African exports.

- South Korea Foreign Minister said South Korea is not intentionally delaying US investment.

- Venezuela and Qatar review bilateral agenda to strengthen cooperation.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were ultimately mixed after the global market rout rolled over into the region following the continued tech woes stateside and weak US labour market data. Nonetheless, most of the regional benchmark indices are well off their worst levels, as the early sell-off gradually stabilised. ASX 200 was among the underperformers with the index dragged lower by heavy tech losses, and with sentiment also not helped by M&A-related disappointment after the proposed Rio Tinto-Glencore merger fell through, while there were comments from RBA Governor Bullock, who noted the RBA board is not happy with inflation and the prospects of getting it down. Nikkei 225 initially declined amid the broad risk-off mood and disappointing Household Spending data, but then recovered as sentiment improved and with participants awaiting the snap election on Sunday, where the ruling bloc is widely anticipated to achieve a landslide victory. Hang Seng and Shanghai Comp were mixed amid a lack of fresh pertinent catalysts and with the mainland clawing back all of its early losses following another two-pronged liquidity operation by the PBoC utilising both 7-day and 14-day reverse repos.

Top Asian News

- Indonesian President said they signed a security treaty with Australia.

- Former Bank of China (3988 HK) Vice President was expelled from the China Communist Party for serious violations of discipline and law.

- China's Ministry of Agriculture issues implementation plan to advance rural revitalisation and agricultural modernisation.

- Japan ruling parties expected to win over 300 seats out of the 465 seats in the lower house election, according to Nikkei.

European bourses (STOXX 600 +0.1%) broadly opened on the backfoot but have gradually moved higher as the morning progressed. European sectors opened with a clear negative bias but are now mixed. Construction leads, boosted by upside in Vinci (+6.5%). To the downside, Autos has been hit by significant pressure in Stellantis (-22.3%). The Co. noted it is to take a EUR 22bln charge as it resets its business and scales back on its recent EV push.

Top European News

- Russian Ambassador said the UK and France should participate if there is a serious talk multilateral nuclear disarmament.

- UK and China working group will work towards an MOU between the PBoC and BoE.

- ECB's Escriva said there is always room for changes in monetary policy; inflation is at target and expectations are anchored.

FX

- DXY marginally pulled back since the start of the APAC session after gaining against its peers yesterday amid haven appeal and as the buck continued to nurse some of its YTD weakness, with momentum following the Warsh Fed Chair nomination remaining intact yesterday, despite the slew of weaker-than-expected labour market metrics. The European morning has seen trade within tight parameters as traders look ahead to the University of Michigan prelim survey and comments from Fed's Jefferson. DXY resides in a 97.75-97.97 range after finding support near 98.00 once again after printing a 97.60-97.98 parameter yesterday.

- EUR/USD ekes mild gains and retested the 1.1800 level, albeit with price action contained following the uneventful ECB policy announcement yesterday, with several ECB speakers offering commentary today, albeit with no obvious impact on EUR assets. Further, the ECB Survey of Professional Forecasters suggested headline and core HICP inflation expectations unchanged across all horizons, while Real GDP growth expectations unchanged except for a slight upward revision for 2026. EUR/USD currently trades within a 1.1765-1.1801, versus Thursday's 1.1775-1.1822 range.

- GBP/USD regained some composure after the prior day's underperformance, which was caused by the BoE's dovish vote split and UK political woes and calls grow for UK PM Starmer to resign. GBP/USD trades between 1.3508-1.3581 compared to yesterday's wide 1.3518-1.3654 parameter.

- USD/JPY declined overnight but trimmed losses to trade flat at the time of writing, but with price action choppy ahead of the election on Sunday and following disappointing Household Spending data from Japan, while BoJ's Masu reiterated that the central bank will raise rates if the economy and prices are in line with the BoJ's outlook.

- Antipodeans outperform across the G10 space, rebounding from a weekly trough as the early sell-off in metals and stocks gradually stabilised and then reversed.

Fixed Income

- USTs are firmer by a handful of ticks, remaining at the elevated levels seen in the prior session. As a reminder, the strength seen on Thursday was attributed to: a) risk-off sentiment, b) poor US jobs data, c) a dovish hold at the BoE. Newsflow is lacking this morning, aside from the recommencement of US-Iran talks in Oman – the key risk is that talks break down, leading to a potential US strike on Iran. Geopols aside, focus will be on the US data slate, which includes the UoM survey. Currently within a 112-06+ to 112-16+ range.

- Bunds are also firmer this morning, following peers; currently firmer by around 15 ticks and trading within a 128.31-128.58 range. Earlier, German Exports rose more than expected with Imports also topping expectations – promising data from the region, though more focus was on the Industrial Production. The metric fell sharply in December, which highlights the uncertain nature of Germany’s recovery. Following this data, Bunds rose from 128.37 to a high of 128.46, before scaling back to just under the 128.40 mark where the benchmark currently resides. Several ECB speakers have appeared throughout the day, Kazaks highlighted risks of the stronger EUR, whilst Rehn suggested that there's a real risk of lower-than-expected inflation.

- Australia sold AUD 800mln 1.00% December 2030 bonds, b/c 4.14, avg. yield 4.3641%.

Commodities

- WTI and Brent briefly dipped below USD 63/bbl and USD 67/bbl, respectively at the start of the Asia-Pac session, before steadily bidding higher as European trade gets underway. The key event traders will be looking out for today is any reporting following the US-Iran nuclear talks in Oman. As of writing, the meeting has gotten underway but there have been reports that a convoy carrying US officials has left the site where the talks have been taking place.

- Spot gold is trading stronger today and currently at the upper end of a USD 4,655.23-4,903.40/oz range, and just above its 21 DMA (USD 4,848/oz). Focus remains on geopolitical updates out of Oman as the US and Iran remain in meetings.

- Base metals hold a negative bias this morning but have gradually picked up off worst levels as the risk tone improves. 3M LME Copper currently trades in a USD 12,540-12,896.78/t range.

- China's National Gold Group to constrain precious metals repurchase business from the 7th of February.

- China's Shanghai Gold Exchange to increase margin ratios, price limits for some gold and silver contracts from the 9th of February closing settlement.

- Weekly SHFE warehouse stocks change (W/W): Copper +6.8%, Aluminium +13.1%, Zinc +8.5%, Lead +56.4%.

- Iraq's SOMO Director said they are planning to boost oil export from the south by 120k BPD.

- Thailand's TFEX announces the temporary trading halt of silver online futures.

- Mexico reportedly evaluating how to send fuel to Cuba while avoiding US tariffs.

Central Banks

- BoJ's Masu said he does not think the BoJ is behind the curve and need to monitor the impact of FX on inflation. Timing of rate hikes to neutral is not predetermined. Not suggesting food price moves need immediate action. Watching food inflation beyond rice prices. Policy should be carefully guided to keep underlying inflation around 2%. True that Japan's negative real interest rate is likely behind rises in property prices. Past pace of rate hikes will not be any guide to the future pace of hikes.

- BoJ's Masu said the central bank is closely watching FX market moves and their impact on the economy and prices, also noted that appropriate and timely rate hike is needed. said:. BoJ will raise rates if the economy and prices are in line with the BoJ's outlook. Cause of inflation also warrants close attention, in terms of whether inflation is truly caused by supply-side factors alone or by a combination of both demand- and supply-side factors. Real interest rate remains at a significantly negative level in Japan. Convinced that continuing with further policy interest rate hikes will be needed to complete the normalisation of monetary policy in Japan.

- BofA expects ECB to hold rates in 2026 (prev. 25bp cut in March), sees 25bps cuts in March and June 2027.

- ECB Survey of Professional Forecasters: Headline and core HICP inflation expectations unchanged across all horizons; Real GDP growth expectations unchanged except for a slight upward revision for 2026. Unemployment rate expectations unchanged for 2026 and 2027 but slightly lower thereafter.

- ECB's Muller said December's outlook still good for basic decision making.

- ECB's Rehn on their next meeting in March said they will be receiving new data and updates for ECB's forecast, allowing them to refine their assessment of the Euro area's growth momentum and inflation dynamic. Any changes in the key interest rates in the future, if justified and not executed. Highlights that there's a real risk of lower than expected inflation.

- ECB's Kazaks said that rapid EUR strengthening may trigger a response from the ECB.

- ECB's Villeroy said downside risks are probably more significant; the ECB has no FX target.

- ECB's Stournaras said "we are monitoring exchange rates"; have strong confidence in the economic outlook. ECB is monitoring the FX rate, but euro increase has not been dramatic. FX rate levels are not a primary focus. January inflation data should be viewed in context. Meeting-by-meeting approach has been good practice. Judges that risks are balanced. Do not think we have to take any action now.

- RBA Governor Bullock said RBA board is not happy with inflation and the prospects of getting it down.

- RBA Governor Bullock said much of the recent increase in inflation is judged to be temporary, but some of it seems to be persistent, adds Board will be monitoring closely the extent to which the strong inflation we have observed is persistent or temporary. said:Labour market is still doing very well, calling it good news.

- RBI maintains Repurchase Rate at 5.25%, as expected, via unanimous decision and maintains neutral policy stance.

Geopolitics: Russia-Ukraine

- Russian Ambassador said the UK and France should participate if there is a serious talk multilateral nuclear disarmament.

- Russia's Kremlin said Abu Dhabi talks will continue; on nuclear talks, said Russia and the US realise the need to begin talks soon.

- Deputy Head of Russian Military intelligence shot in Moscow, sources report.

Geopolitics: Middle-East

- Iranian media reported that the second round of Muscat talks does not signify the start of negotiations, and these initial sessions have been held for each party to coordinate with the Omani mediator.

- Second round of nuclear negotiations between the US and Iran have gotten underway.

- An Iranian diplomatic person said the presence of CENTCOM or any military officials can jeopardise indirect nuclear talks between the US and Iran.

- A convoy reportedly carrying American officials leaves the site of the US-Iran talks in Oman, the AP reported; details light.

- US envoy Kushner is also attending US-Iran talks, according to Iranian state TV.

- Iran and US commence nuclear talks in Oman, Iranian media reported.

- Iran's Foreign Minister said they are fully prepared to defend Iran's sovereignty and security against any transgressions.

- US-Iran talks are reportedly delayed by a few hours.

- Israeli media reported that Israeli PM Netanyahu said in closed sessions of the Knesset that political, military and economic factors brought Iran closer to a critical point, although he did not consider the fall of the government to be certain. He warned that any Iranian attack would be met with a "strong response".

- US President Trump posted "Rather than extend “NEW START” (A badly negotiated deal by the United States that, aside from everything else, is being grossly violated), we should have our Nuclear Experts work on a new, improved, and modernized Treaty". Full post: "The United States is the most powerful Country in the World. I completely rebuilt its Military in my First Term, including new and many refurbished nuclear weapons. I also added Space Force and now, continue to rebuild our Military at levels never seen before. We are even adding Battleships, which are 100 times more powerful than the ones that roamed the Seas during World War II — The Iowa, Missouri, Alabama, and others. I have stopped Nuclear Wars from breaking out across the World between Pakistan and India, Iran and Israel, and Russia and Ukraine. Rather than extend “NEW START” (A badly negotiated deal by the United States that, aside from everything else, is being grossly violated), we should have our Nuclear Experts work on a new, improved, and modernized Treaty that can last long into the future. Thank you for your attention to this matter! PRESIDENT DONALD J. TRUMP".

Geopolitics: Others

- US to resume aid to North Korea whilst outreach stalls, via the WSJ. According to a US official, the decision isn't an act of gesture but rather as a de facto block on aid to North Korea.

- Senior South Korea official said expects progress in a few days regarding the North Korea issue, according to Yonhap.

US Event Calendar

- 10:00 am: United States Feb P U. of Mich. Sentiment, est. 55, prior 56.4

- 12:00 pm: United States Fed’s Jefferson Speaks on the Economy

DB's Jim Reid concludes the overnight wrap

Risk assets came under mounting pressure over the last 24 hours, as concerns around AI and a weak batch of US data led to growing questions about the near-term outlook. Once again, software led the sell-off, with the S&P 500’s software component (-5.01%) posting a 7th consecutive fall, whilst the broader S&P 500 (-1.23%) fell for a 3rd session running. But there were clear signs of stress more widely, with the VIX index (+3.13pts) reaching a new 2026 high of 21.77pts, whilst Bitcoin (-13.14%) saw its worst daily decline since November 2022, closing at a 15-month low of $63,083 and down almost 50% from its October peak. Overnight, it even surpassed that 50% threshold, falling to just $60,033 after midnight in London, but it’s since bounced back to $65,366 again. Meanwhile, the risk-off mood drove a sharp rally in Treasuries, with 2yr yields (-10.3bps) posting their biggest decline in six months. And there’s no sign of the sell-off finding a floor just yet, as disappointing results from Amazon after the US close have meant that futures on the S&P 500 are down another -0.50% this morning.

That latest software decline now leaves its S&P 500 component down -29.9% from its October peak. And if you’d just known that US software would be in bear market territory back then, you’d be forgiven for thinking markets would have seen a huge correction by now. However, what we’ve actually seen is a significant rotation, which Jim looked at in yesterday’s chart of the day (link here). So other sectors have taken up the baton from tech, such as energy, materials and consumer staples, meaning that the overall S&P 500 still only closed -2.6% beneath its record high from last month.

Interestingly, that pattern echoes what we saw in 2000 as the dot-com bubble started to burst. Equities started to fall from the March 2000 as tech stocks saw significant declines. However, consumer staples, utilities and healthcare rallied significantly over the months ahead, and in September the S&P 500 actually came within a percentage point of its record high from six months earlier. So it shows that a market can absorb a prolonged rotation without obvious index-level stress for some time. But the longer and deeper the sell-off in a dominant sector becomes, the harder it is for the broader index to withstand the drag, and the continued losses for tech in 2000 ultimately meant the S&P 500 ended that year over -10% lower.

This latest sell-off has shown no sign of easing yet, and it got further momentum as Amazon reported after the close last night. Its net sales guidance was largely in line with expectations but this was accompanied by a sharp rise in planned capex spending, which is expected to reach $200bn this year, well above expectations. That spending also weighed on the operating income guidance ($16.5-21.5bn in the current quarter vs $22.2bn estimated) and pushed Amazon’s shares down by more than -10% in after-hours trading.

All that follows a difficult session yesterday, where the S&P 500 (-1.23%) posted a fresh decline that made this its worst 3-day run (-2.55%) since November. And with tech leading the sell-off, the NASDAQ (-1.59%) is now on its worst 3-day run (-4.46%) since the post-Liberation Day turmoil last April. But whilst tech has been the main focus, yesterday also brought signs of the sell-off broadening out, with a wider range of sectors losing ground. For instance, both the equal-weighted S&P 500 (-0.6x%) and Europe’s STOXX 600 (-1.05%) fell back from their record highs on Wednesday, showing that it wasn’t just a tech story. Indeed, the defensive consumer staples (+0.25%) and utilities (+0.11%) sectors were the only ones in the S&P 500 to eke out gains and the small-cap Russell 2000 (-1.79%) saw a large pullback as well.

The sell-off really wasn’t helped by the latest batch of US data, which helped to feed the more negative market narrative. Indeed, a crucial factor driving the market’s resilience this year despite various shocks has been the consistent data resilience. So any signs the data is softening would take away a key support that’s held things up amidst the volatility elsewhere. In terms of yesterday’s releases, the weekly initial jobless claims spiked up to an 8-week high of 231k in the week ending Jan 31 (vs. 212k expected). Then 90 minutes later, the JOLTS report showed that US job openings fell to just 6.542m in December (vs. 7.25m expected), which is their lowest level since 2020, coming in below every economist’s estimate on Bloomberg.

Those signs of labour market weakness meant investors priced in more Fed rate cuts this year, as the data was seen as offering them more space to ease policy. For instance, the amount of cuts priced by the December meeting was up +10.0bps on the day to 60bps. And in turn, that helped to push Treasury yields lower across the curve, with the 2yr yield (-10.3bps) seeing its biggest decline since August to 3.45%, whilst the 10yr yield (-9.5bps) fell to 4.18%.

That bond rally got further support from the latest decline in commodity prices, which eased concerns about inflation. So Brent crude oil fell -2.75% to $67.55/bbl amidst the weaker data as well as news that US-Iran negotiations are set to go ahead in Oman today. And there was a fresh rout in precious metals, with gold prices (-3.74%) down to $4,779/oz, while silver (-19.57%) saw its second-sharpest decline on record to $70.92/oz. Following on the -26% fall last Friday, that left silver down -1% YTD, having been up +62% as of Wednesday last week, although it’s bounced back a bit overnight to move back into positive territory for the year, at $73.41/oz

Earlier in Europe, there wasn’t too much excitement from the latest ECB meeting, where it kept its deposit rate at 2% as expected. President Lagarde said that inflation was in a “good place”, and as our European economists write in their reaction note (link here), there was no sense of an imminent change in policy in either direction. So market expectations continue to see the ECB holding rates for the rest of the year, with the risks skewed towards another cut, and yields on 10yr bunds (-1.7bps) and OATs (-0.2bps) only saw modest declines.

In the UK, however, the Bank of England’s decision led to a clear market reaction, as the decision had several dovish elements. It kept rates on hold as expected at 3.75%, but this was a narrow 5-4 vote, with the other 4 preferring a 25bp rate cut. And looking forward, the statement said that rates were “likely to be reduced further”. So that led to a significant rally for front-end gilts, with the 2yr yield (-5.6bps) down to 3.64%, whilst the pound sterling weakened -0.90% against the US Dollar. Moreover, those moves were exacerbated by the latest political drama, with mounting speculation around PM Starmer’s position seeing UK assets come under fresh pressure. Indeed, long-end bond yields posted a fresh increase, with the 30yr gilt yield (+4.2bps) up to 5.37%. And the 2s10s yield curve (+6.4bps) reached its steepest since 2018, at 89.5bps.

Overnight in Asia, we’ve seen a more mixed performance for equities. In Japan, both the Nikkei (+0.38%) and the TOPIX (+0.76%) have rallied ahead of the country’s general election this Sunday, where PM Sanae Takaichi is seeking her own mandate after becoming PM last October. However, there’s been significant weakness elsewhere, with the Hang Seng (-1.25%) and the KOSPI -1.95%) seeing sharper losses. Moreover, the latest slump for Australia’s S&P/ASX 200 (-2.03%) leaves the index in negative territory for the year so far as it stands. Otherwise, there’s been a steadier performance for the Shanghai Comp (+0.18%) and the CSI 300 (-0.11%).

Looking at the day ahead, data releases include German industrial production for December, and in the US there’s the University of Michigan’s preliminary consumer sentiment index for February. Otherwise, central bank speakers include Fed Vice Chair Jefferson, the ECB’s Cipollone and Kocher, and the BoE’s Pill.

Tyler Durden

Fri, 02/06/2026 - 08:50

via Associated Press

via Associated Press

Illustrative prior prisoner swap. There have been several throughout the 4-year long war.

Illustrative prior prisoner swap. There have been several throughout the 4-year long war.

A drone view shows a general view of Nuuk, Greenland, on Jan. 15, 2026. REUTERS/Marko Djurica

A drone view shows a general view of Nuuk, Greenland, on Jan. 15, 2026. REUTERS/Marko Djurica The US military's Pituffik Space Base in Pituffik, Greenland, on March 28, 2025. Jim Watson - Pool/Getty Images

The US military's Pituffik Space Base in Pituffik, Greenland, on March 28, 2025. Jim Watson - Pool/Getty Images Greenland is part of North America. Its capital, Nuuk, is geographically closer to Washington, D.C., than to Copenhagen. Illustration by The Epoch Times, Google Earth

Greenland is part of North America. Its capital, Nuuk, is geographically closer to Washington, D.C., than to Copenhagen. Illustration by The Epoch Times, Google Earth A fishing village near Nuuk, Greenland, on May 4, 2025. John Fredricks/The Epoch Times

A fishing village near Nuuk, Greenland, on May 4, 2025. John Fredricks/The Epoch Times Marie-Agnes Strack-Zimmermann, NATO Secretary General Mark Rutte and Chair of the Committee on Foreign Affairs of the European Parliament David McAllister arrive to address committees of the European Union Parliament about Greenland negotiations in Brussels, on Jan. 26, 2026. Omar Havana/Getty Images

Marie-Agnes Strack-Zimmermann, NATO Secretary General Mark Rutte and Chair of the Committee on Foreign Affairs of the European Parliament David McAllister arrive to address committees of the European Union Parliament about Greenland negotiations in Brussels, on Jan. 26, 2026. Omar Havana/Getty Images A U.S. Marine eats a military field ration during a field exercise at Combined Arms Training Center Camp Fuji, Japan, on Dec. 11, 2025. Lance Cpl. Weston Brown/U.S. Marine Corps via DVIDS

A U.S. Marine eats a military field ration during a field exercise at Combined Arms Training Center Camp Fuji, Japan, on Dec. 11, 2025. Lance Cpl. Weston Brown/U.S. Marine Corps via DVIDS Tractor spreading Round-Up (glyphosate) on wheat straw with a spraying machine in Normandy, France, September 2007. Leitenberger Photography/Shutterstock

Tractor spreading Round-Up (glyphosate) on wheat straw with a spraying machine in Normandy, France, September 2007. Leitenberger Photography/Shutterstock Chow hall employees and a Marine officer serve food to Marines and sailors during the 241st Navy Birthday Meal held at Marine Corps Air Station New River, on Oct. 13, 2016. Cpl. Melodie Snarr/U.S. Marine Corps via DVIDS

Chow hall employees and a Marine officer serve food to Marines and sailors during the 241st Navy Birthday Meal held at Marine Corps Air Station New River, on Oct. 13, 2016. Cpl. Melodie Snarr/U.S. Marine Corps via DVIDS

Recent comments